- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Quantum Computing (QUBT) Seals First U.S. Commercial Sale With Top 5 Bank

Reviewed by Simply Wall St

Quantum Computing (QUBT) recently secured its first U.S. commercial sale for quantum cybersecurity solutions with a Top 5 U.S. Bank, a major milestone that highlights its advancements in the quantum communications market. This event coincided with a significant 84% price increase in the last quarter, potentially bolstered by strong Q1 earnings showing a net income turnaround and key executive appointments. While broader markets have faced declines due to economic uncertainties, Quantum Computing's entry into the commercial sphere and the closing of a substantial private placement may have countered these trends, reinforcing its positive trajectory against prevailing market headwinds.

Quantum Computing Inc.'s shares have experienced an extraordinary total return of over 2300% over the past year, reflecting the company's rapid growth and market recognition. Comparatively, over the past year, the company's performance has significantly outpaced both the US Tech industry and the broader US Market, which returned -7.2% and 17.7%, respectively. This remarkable outperformance underscores investor confidence and the strategic direction of the company.

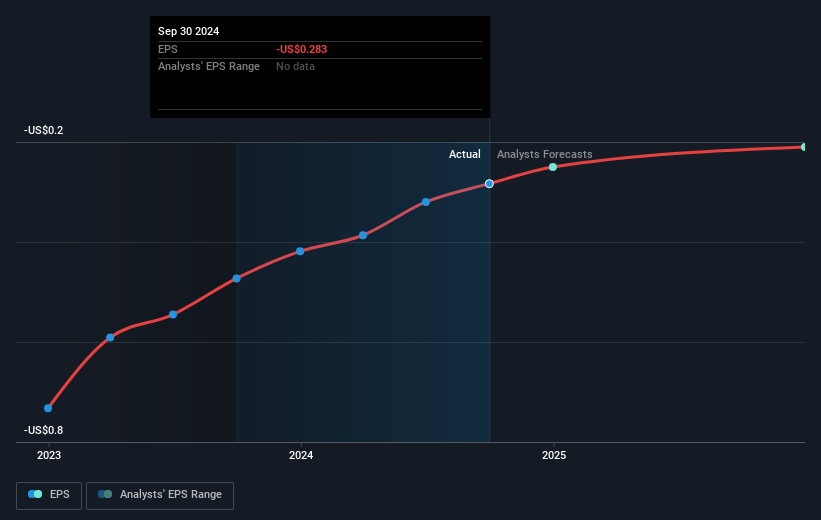

The recent achievements, including quantum cybersecurity sales and a net income turnaround, could positively influence future revenue and earnings forecasts. However, it's important to note that, despite the recent share price surge to US$14.80, it remains below the consensus analyst price target of US$18.50, representing a potential upside according to market predictions. The company's strategic moves may support its trajectory towards this target, although analysts' consensus reflects varying degrees of confidence due to limited coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet medium-low.

Market Insights

Community Narratives