- United States

- /

- Biotech

- /

- NasdaqGS:SVRA

Promising Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 and Dow Jones Industrial Average reaching new heights, investors are keenly watching for opportunities amidst potential economic uncertainties such as a looming government shutdown. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those seeking growth at lower price points. Despite their vintage-sounding name, these stocks can offer significant upside when backed by strong financials and solid fundamentals. In this article, we explore several penny stocks that stand out as promising candidates for those looking to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.07 | $445.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $698.01M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.16 | $222.33M | ✅ 4 ⚠️ 2 View Analysis > |

| Sensus Healthcare (SRTS) | $3.14 | $52.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $24.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.68 | $20.88M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.98 | $7.26M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.87 | $91.31M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $3.99 | $9.9M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 373 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Village Farms International (VFF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Village Farms International, Inc. operates in North America producing, marketing, and distributing greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes with a market cap of $375.11 million.

Operations: The company's revenue is primarily derived from its produce segment at $169.35 million, followed by Canadian cannabis operations generating $150.02 million, U.S. cannabis contributing $16.30 million, and clean energy at $1.54 million.

Market Cap: $375.11M

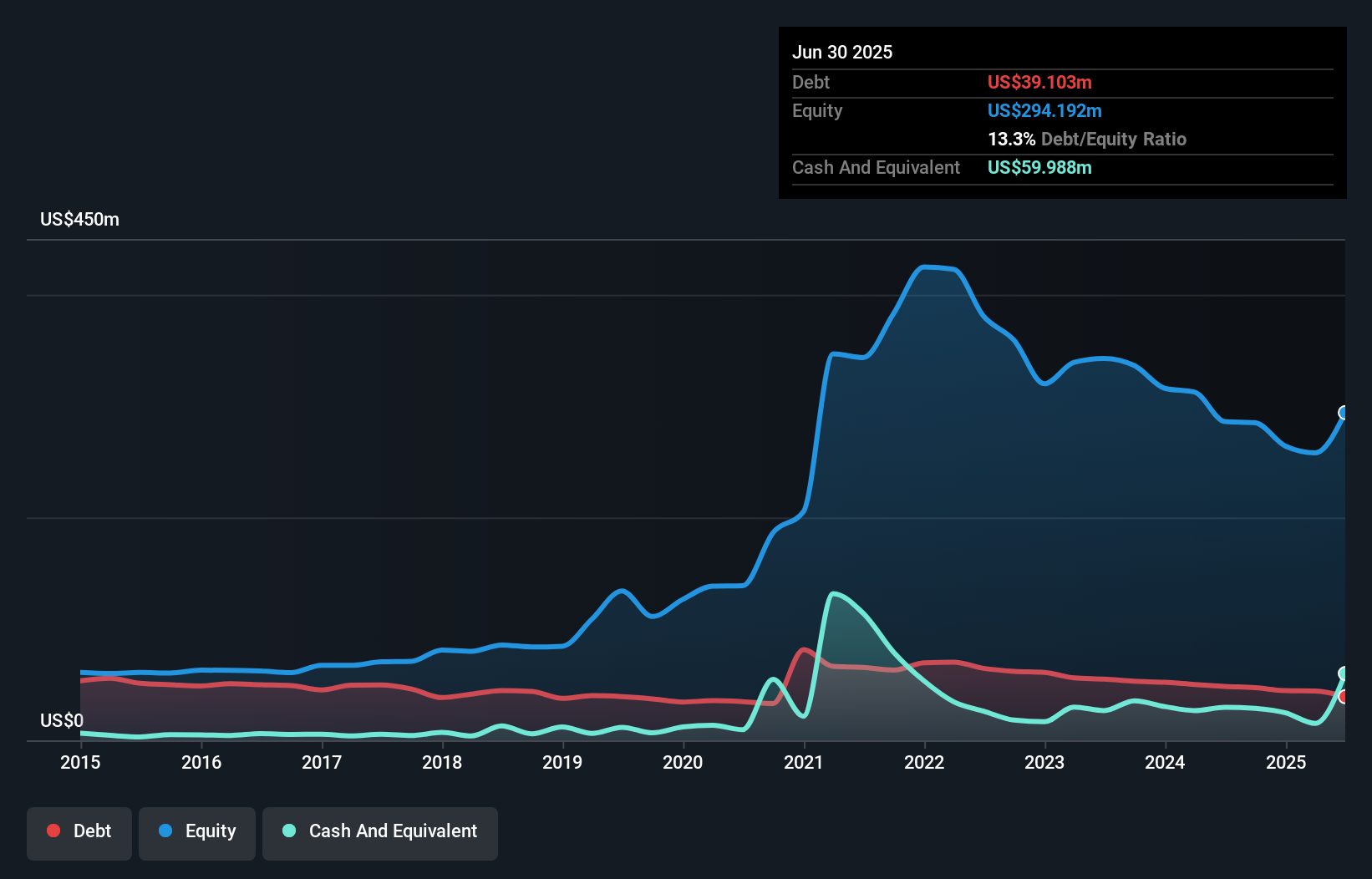

Village Farms International has been navigating the penny stock landscape with a focus on expanding its cannabis operations. Recent earnings reports show a turnaround from losses, with net income reaching US$26.5 million in Q2 2025, compared to a loss the previous year. The company announced a share buyback program worth US$10 million, signaling confidence in its financial health. Despite being unprofitable overall, Village Farms has sufficient cash runway for over three years and is leveraging its extensive greenhouse capacity for future growth in both Canadian and potential U.S. cannabis markets. However, volatility remains high and profitability challenges persist.

- Click here and access our complete financial health analysis report to understand the dynamics of Village Farms International.

- Explore Village Farms International's analyst forecasts in our growth report.

Savara (SVRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Savara Inc. is a clinical-stage biopharmaceutical company specializing in rare respiratory diseases with a market cap of $741.63 million.

Operations: Savara Inc. has not reported any revenue segments as it is a clinical-stage biopharmaceutical company focusing on rare respiratory diseases.

Market Cap: $741.63M

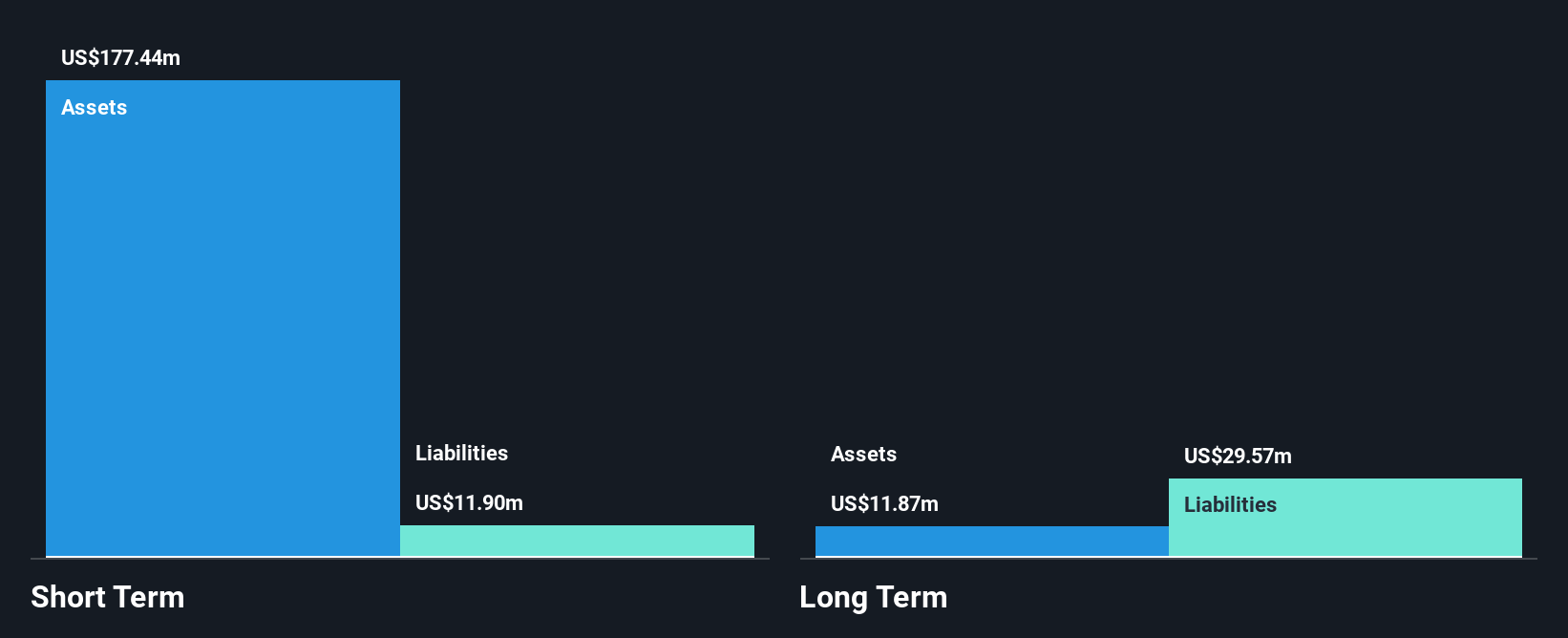

Savara Inc. is navigating the penny stock realm as a pre-revenue clinical-stage biopharmaceutical firm focused on rare respiratory diseases. Despite its lack of revenue, Savara's short-term assets significantly surpass its liabilities, providing some financial stability. However, the company faces challenges with ongoing legal issues related to alleged misrepresentations about its lead drug candidate, MOLBREEVI. Recent clinical trial results for molgramostim in treating autoimmune pulmonary alveolar proteinosis showed promising improvements in patient outcomes but were overshadowed by FDA requests for additional data delaying regulatory approval and increasing capital needs. The management team remains experienced in addressing these hurdles.

- Click to explore a detailed breakdown of our findings in Savara's financial health report.

- Understand Savara's earnings outlook by examining our growth report.

Alight (ALIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alight, Inc. is a technology-enabled services company operating globally with a market capitalization of approximately $1.76 billion.

Operations: The Employer Solutions segment generated $2.31 billion in revenue.

Market Cap: $1.76B

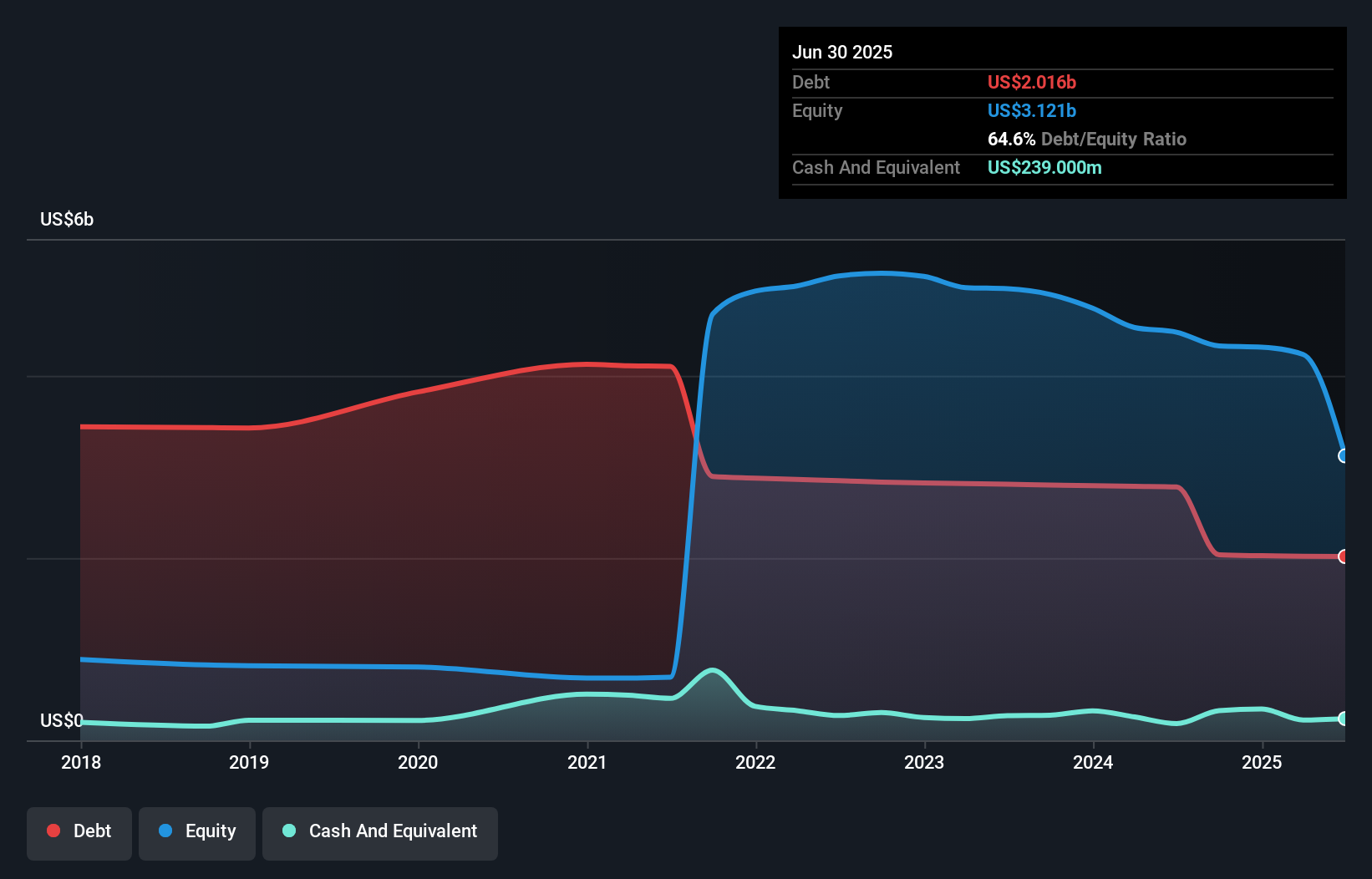

Alight, Inc. is navigating challenges typical of many penny stocks, with recent financial performance showing a net loss of US$1.07 billion in the second quarter despite generating US$528 million in sales. The company's debt to equity ratio has improved significantly over five years, and it maintains a positive cash flow that supports its operations for more than three years without additional capital. Recent partnerships, such as with Sword Health, aim to enhance service offerings and client outcomes. However, Alight's unprofitability and substantial long-term liabilities remain key concerns for investors considering this stock category.

- Take a closer look at Alight's potential here in our financial health report.

- Examine Alight's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Investigate our full lineup of 373 US Penny Stocks right here.

- Curious About Other Options? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SVRA

Savara

A clinical stage biopharmaceutical company, focuses on rare respiratory diseases.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives