- India

- /

- Real Estate

- /

- NSEI:PRAENG

Prajay Engineers Syndicate (NSE:PRAENG) Has A Somewhat Strained Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Prajay Engineers Syndicate Limited (NSE:PRAENG) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Prajay Engineers Syndicate

What Is Prajay Engineers Syndicate's Net Debt?

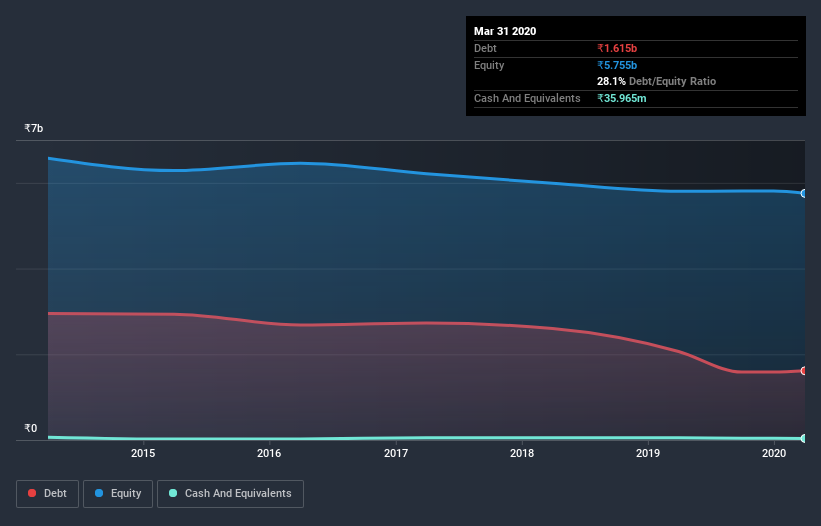

You can click the graphic below for the historical numbers, but it shows that Prajay Engineers Syndicate had ₹1.61b of debt in March 2020, down from ₹2.07b, one year before. However, it also had ₹36.0m in cash, and so its net debt is ₹1.58b.

How Strong Is Prajay Engineers Syndicate's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Prajay Engineers Syndicate had liabilities of ₹4.94b due within 12 months and liabilities of ₹1.58b due beyond that. On the other hand, it had cash of ₹36.0m and ₹1.92b worth of receivables due within a year. So its liabilities total ₹4.6b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹477.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Prajay Engineers Syndicate would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.18 times and a disturbingly high net debt to EBITDA ratio of 31.1 hit our confidence in Prajay Engineers Syndicate like a one-two punch to the gut. The debt burden here is substantial. The good news is that Prajay Engineers Syndicate grew its EBIT a smooth 81% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Prajay Engineers Syndicate will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Prajay Engineers Syndicate actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Prajay Engineers Syndicate's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that Prajay Engineers Syndicate's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Prajay Engineers Syndicate you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Prajay Engineers Syndicate or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PRAENG

Prajay Engineers Syndicate

Engages in the construction, development, maintenance, and sale of residential, commercial, hospitality, and retail properties in India.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks