Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies PNM Resources, Inc. (NYSE:PNM) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for PNM Resources

What Is PNM Resources's Debt?

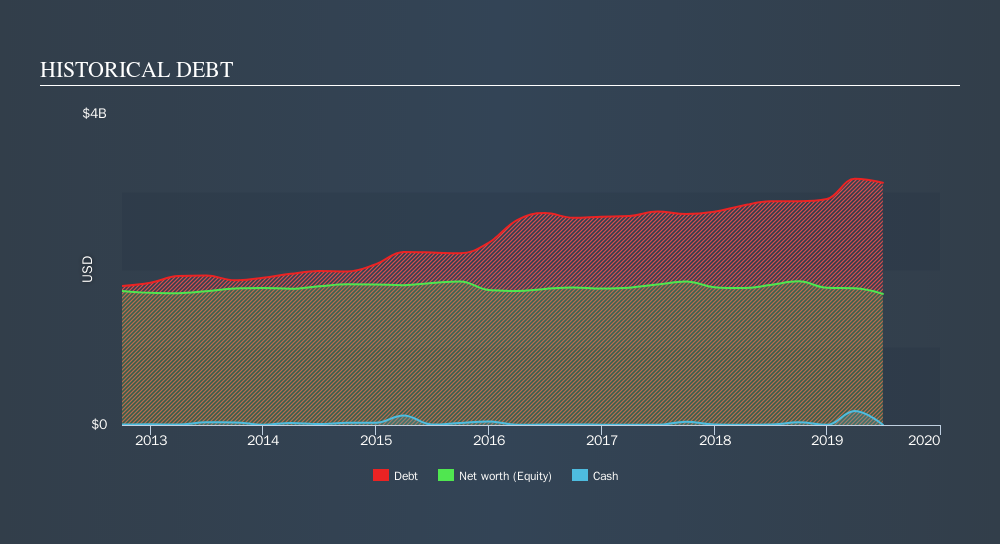

The image below, which you can click on for greater detail, shows that at June 2019 PNM Resources had debt of US$3.11b, up from US$2.88b in one year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is PNM Resources's Balance Sheet?

We can see from the most recent balance sheet that PNM Resources had liabilities of US$666.5m falling due within a year, and liabilities of US$4.70b due beyond that. On the other hand, it had cash of US$4.23m and US$165.6m worth of receivables due within a year. So its liabilities total US$5.19b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's US$3.94b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

PNM Resources shareholders face the double whammy of a high net debt to EBITDA ratio (9.1), and fairly weak interest coverage, since EBIT is just 0.49 times the interest expense. This means we'd consider it to have a heavy debt load. Even worse, PNM Resources saw its EBIT tank 82% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if PNM Resources can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, PNM Resources recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for and improvement.

Our View

To be frank both PNM Resources's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its conversion of EBIT to free cash flow fails to inspire much confidence. It's also worth noting that PNM Resources is in the Electric Utilities industry, which is often considered to be quite defensive. Considering all the factors previously mentioned, we think that PNM Resources really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. Given the risks around PNM Resources's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:TXNM

TXNM Energy

Through its subsidiaries, provides electricity and electric services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives