Stock Analysis

Pinning Down Majesco Limited's (NSE:MAJESCO) P/E Is Difficult Right Now

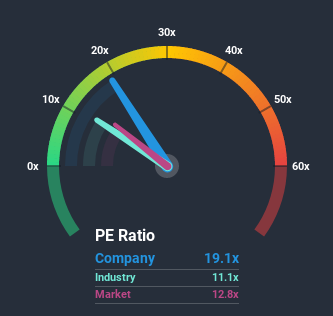

Majesco Limited's (NSE:MAJESCO) price-to-earnings (or "P/E") ratio of 19.1x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Majesco as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Majesco

How Is Majesco's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Majesco's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 1,015% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company are not great, suggesting earnings should decline by 4.9% over the next year. Meanwhile, the market is forecast to moderate by 4.2%, which suggests the company won't escape the wider economic forces.

In light of this, it's somewhat peculiar that Majesco's P/E sits above the majority of other companies. We think shrinking earnings are unlikely to make the P/E premium sustainable, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Majesco currently trades on a higher than expected P/E since its earnings forecast is only matching the struggling market. Right now we are uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. In addition, we are concerned whether the company can maintain this level of performance under these tough market conditions. Unless the company's prospects improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Majesco has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you’re looking to trade Majesco, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Aurum PropTech is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:AURUM

Aurum PropTech

Engages in the business of software development for the real estate and other services in India.

Slightly overvalued with limited growth.