- United States

- /

- Electric Utilities

- /

- NYSE:PCG

PG&E (PCG) Partners With Allies To Support Workforce Development Initiatives

Reviewed by Simply Wall St

PG&E (PCG) recently lowered its full-year earnings guidance and reported mixed financial results for the second quarter, which may have influenced investor sentiment. Despite these somewhat challenging updates, PG&E's stock price rose by 13% over the last month, a period coinciding with major stock indices hitting all-time highs due to positive market sentiment following favorable inflation data and expectations of potential interest rate cuts. While PG&E’s specific news was generally less positive, the broader market's upward momentum likely provided strong support to its share price behavior.

We've spotted 2 risks for PG&E you should be aware of, and 1 of them shouldn't be ignored.

The recent updates from PG&E regarding its earnings guidance and mixed quarterly results come at a time of substantial market momentum, which seems to have buoyed its share price. While the broader market conditions have led to a rise in PG&E's share price to US$15.11, the company's long-term total shareholder return over the past five years was 65.89%. Despite this longer-term performance, the company's one-year return lagged behind both the US electric utilities industry, which returned 14.4%, and the broader US market, which returned 19.4% over the past year.

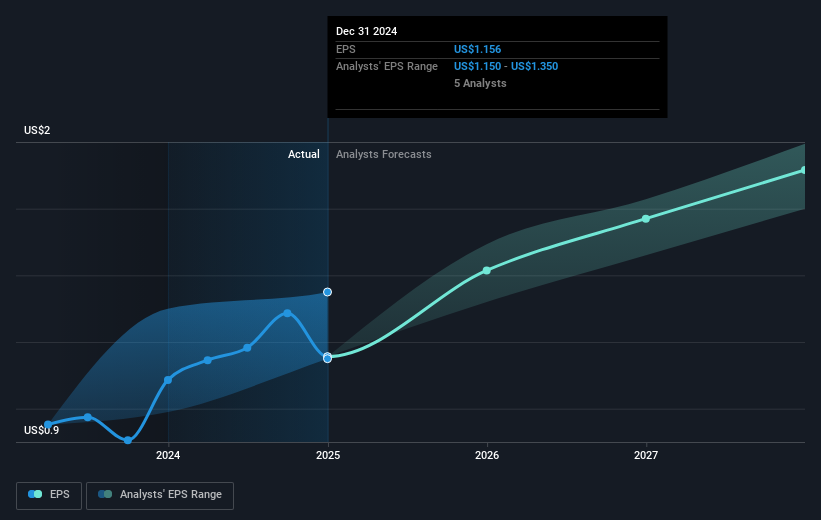

The recent earnings report could affect investor expectations on future revenue and earnings growth, potentially challenging the current narrative of structural demand growth and efficiency improvements driving higher margins. Analysts have set a price target of US$20.60 for PG&E, indicating a potential upside of approximately 36.3% given the current price. Expectations for revenue to reach US$27.6 billion and earnings to rise to US$4 billion by 2028 hinge on market conditions and regulatory developments unfolding as anticipated. The recent news may necessitate a reassessment of these forecasts, especially if the factors influencing these projections—like wildfire risk mitigation and regulatory changes—shift in response to new data or legislative actions.

Review our historical performance report to gain insights into PG&E's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCG

PG&E

Through its subsidiary, Pacific Gas and Electric Company, engages in the sale and delivery of electricity and natural gas to customers in northern and central California, the United States.

Good value very low.

Similar Companies

Market Insights

Community Narratives