- Canada

- /

- Aerospace & Defense

- /

- TSX:XTRA

Patriot One Technologies Inc. (TSE:PAT) Just Reported, And Analysts Assigned A CA$1.15 Price Target

There's been a notable change in appetite for Patriot One Technologies Inc. (TSE:PAT) shares in the week since its third-quarter report, with the stock down 10% to CA$1.04. Revenues fell badly short of expectations, with sales of CA$1.2m, missing analyst estimates by 42%. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimate suggests is in store for next year.

Check out our latest analysis for Patriot One Technologies

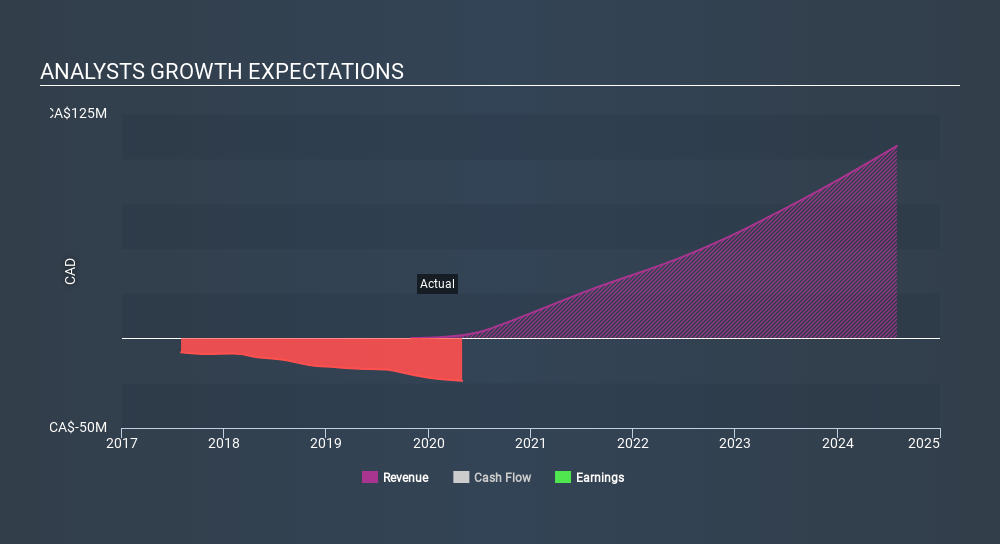

Taking into account the latest results, the most recent consensus for Patriot One Technologies from sole analyst is for revenues of CA$27.0m in 2021 which, if met, would be a sizeable 1502% increase on its sales over the past 12 months. Before this earnings result, the analyst had predicted CA$28.4m revenue in 2021, although there was no accompanying EPS estimate. The consensus seems a bit less optimistic overall, with the revenue forecasts following the latest results.

Intriguingly,the analyst has cut their price target 15% to CA$1.15 showing a clear decline in sentiment around Patriot One Technologies' valuation.

The Bottom Line

The clear low-light was that the analyst cut their forecast revenue estimates for Patriot One Technologies next year. They also downgraded their revenue estimates, although industry data suggests that Patriot One Technologies' revenues are expected to grow faster than the wider industry. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Patriot One Technologies' future valuation.

We have estimates for Patriot One Technologies from one covering analyst, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Patriot One Technologies (1 is concerning!) that you need to be mindful of.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:XTRA

Xtract One Technologies

Engages in the research, development, and commercialization integrated, layered, artificial intelligence powered threat detection gateway solutions, with the aim of enhancing public safety in the United States, Japan, France, the United Kingdom, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion