Olivier Legrain became the CEO of Ion Beam Applications SA (EBR:IBAB) in 2012. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Ion Beam Applications

How Does Olivier Legrain's Compensation Compare With Similar Sized Companies?

Our data indicates that Ion Beam Applications SA is worth €225m, and total annual CEO compensation was reported as €321k for the year to December 2018. Notably, the salary of €321k is the vast majority of the CEO compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of €89m to €355m. The median total CEO compensation was €321k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Ion Beam Applications. Speaking on an industry level, we can see that nearly 63% of total compensation represents salary, while the remainder of 37% is other remuneration. At the company level, Ion Beam Applications pays Olivier Legrain solely through a salary, preferring to go down a conventional route.

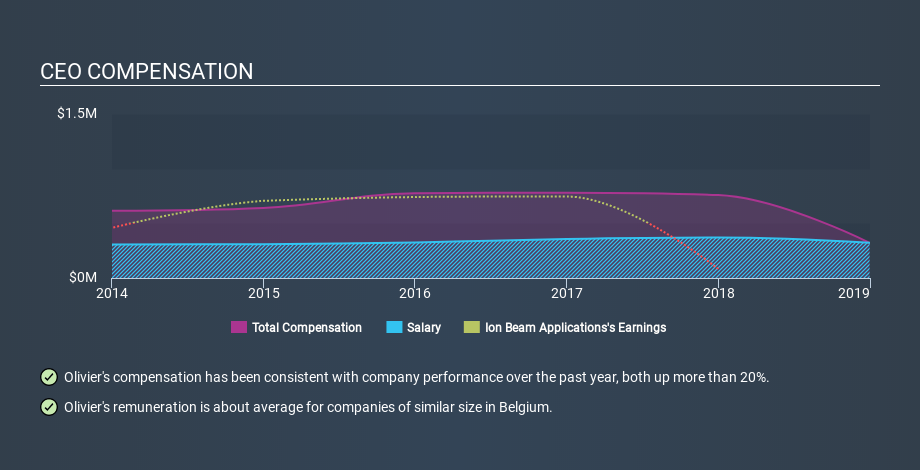

So Olivier Legrain receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. You can see, below, how CEO compensation at Ion Beam Applications has changed over time.

Is Ion Beam Applications SA Growing?

Ion Beam Applications SA has reduced its earnings per share by an average of 14% a year, over the last three years (measured with a line of best fit). Its revenue is up 9.9% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the modest revenue growth over 12 months isn't much comfort against the reduced earnings per share. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. It could be important to check this free visual depiction of what analysts expect for the future.

Has Ion Beam Applications SA Been A Good Investment?

Since shareholders would have lost about 85% over three years, some Ion Beam Applications SA shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Remuneration for Olivier Legrain is close enough to the median pay for a CEO of a similar sized company .

After looking at EPS and total shareholder returns, it's certainly hard to argue the company has performed well, since both metrics are down. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves. Taking a breather from CEO compensation, we've spotted 2 warning signs for Ion Beam Applications (of which 1 can't be ignored!) you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTBR:IBAB

Ion Beam Applications

Designs, produces, and markets solutions for cancer diagnosis and treatments in Belgium, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion