FBL Financial Group, Inc. (NYSE:FFG) is about to trade ex-dividend in the next 3 days. Investors can purchase shares before the 13th of September in order to be eligible for this dividend, which will be paid on the 30th of September.

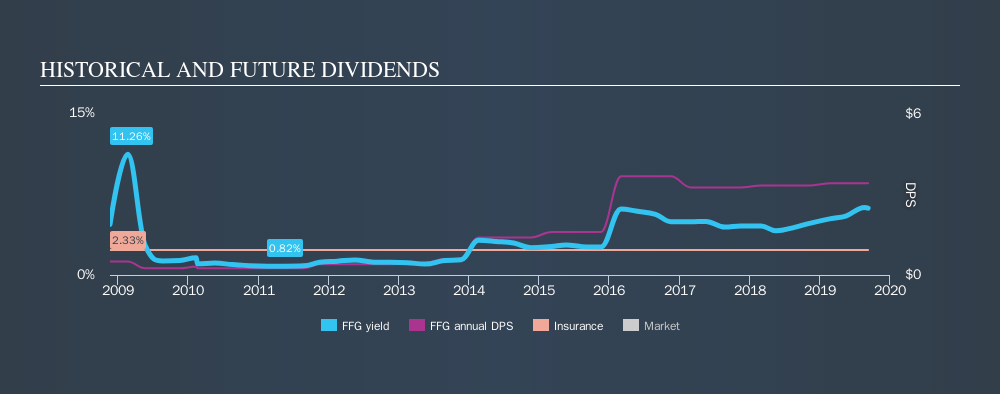

FBL Financial Group's next dividend payment will be US$0.48 per share. Last year, in total, the company distributed US$3.42 to shareholders. Looking at the last 12 months of distributions, FBL Financial Group has a trailing yield of approximately 6.2% on its current stock price of $54.9. If you buy this business for its dividend, you should have an idea of whether FBL Financial Group's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for FBL Financial Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see FBL Financial Group paying out a modest 45% of its earnings.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit FBL Financial Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's not encouraging to see that FBL Financial Group's earnings are effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. FBL Financial Group has delivered an average of 21% per year annual increase in its dividend, based on the past ten years of dividend payments.

The Bottom Line

Has FBL Financial Group got what it takes to maintain its dividend payments? FBL Financial Group's earnings per share have not grown at all in recent years, although we like that it is paying out a low percentage of its earnings. At best we would put it on a watch-list to see if business conditions improve, as it doesn't look like a clear opportunity right now.

Curious about whether FBL Financial Group has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion