- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Ventures Into Autonomous Driving And Consumer Robotics

Reviewed by Simply Wall St

Easyrain has made a significant move by partnering with NVIDIA (NasdaqGS:NVDA) to advance its road detection technologies. Additionally, NVIDIA's ongoing investment in Skild AI reflects its interest in the burgeoning consumer robotics sector. Over the past quarter, NVIDIA's shares rose 19%, which coincides with notable corporate activities, including robust earnings growth and strategic alliances. Amidst a market impacted by geopolitical tensions, such as the Israel-Iran conflict, which affected broader indexes, NVIDIA's forward-looking initiatives and financial results likely lent weight to its upward trajectory, aligning closely with the tech sector's overall resilience in challenging times.

We've identified 1 weakness for NVIDIA that you should be aware of.

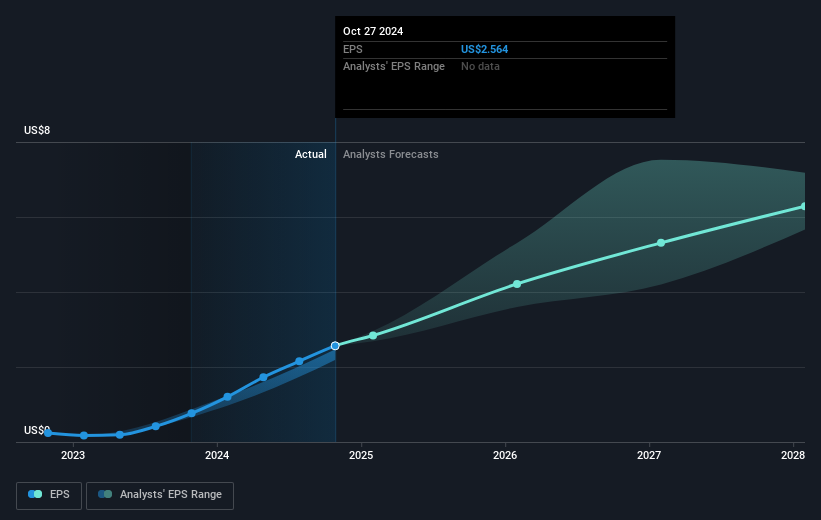

The partnership between Easyrain and NVIDIA creates a potential avenue for NVIDIA to integrate its AI and GPU technologies further into the automotive sector, aligning with the ongoing expansion into autonomous vehicles. This move could bolster revenue and earnings forecasts as NVIDIA taps into the growing demand for enhanced AI capabilities in automotive systems. Additionally, NVIDIA's collaboration with Skild AI and its share price increase of 19% over the past quarter underscore investor confidence fuelled by strategic alliances and earnings growth.

Over the past five years, NVIDIA's shares have seen a very large total return of 1478.19%, reflecting strong performance driven by advancements across gaming, data center, and automotive sectors. In contrast, NVIDIA's one-year return closely matched the US market at 11.7%, while outperforming the semiconductor industry, which reported a 6.1% return. This exemplifies NVIDIA's ability to weather market shifts amid geopolitical tensions, demonstrating resilience in challenging industry landscapes.

Currently, with a share price at US$113.54 and an analyst price target of approximately US$163.12, NVIDIA's stock trades at a notable discount of 30.4% below the target. This suggests that market participants might expect positive revisions to revenue and earnings forecasts as NVIDIA continues to expand its technological foothold in burgeoning AI markets. Such potential aligns with NVIDIA's Blackwell architecture and strategic partnerships, which might enhance its standing in high-margin areas and could support future share price appreciation toward the analyst consensus target.

Assess NVIDIA's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives