- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Powers JUPITER As Europe's Fastest Supercomputer And Boosts Quantum Research

Reviewed by Simply Wall St

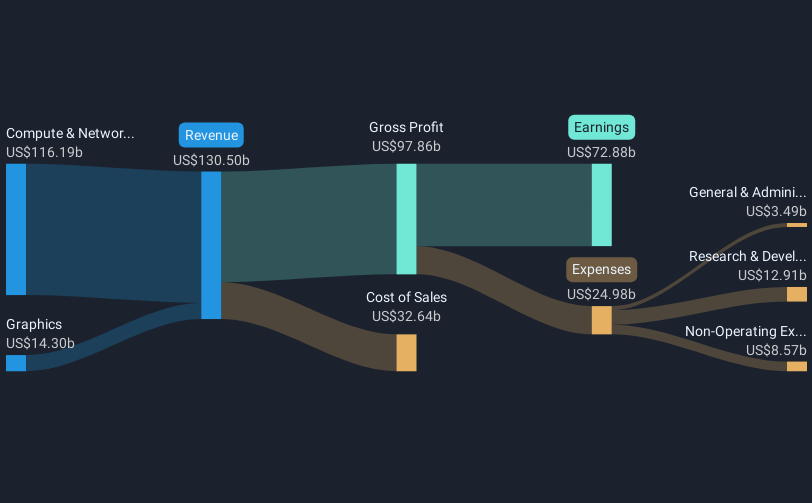

NVIDIA (NasdaqGS:NVDA) has made significant strides with the launch of the JUPITER supercomputer and its innovative collaboration with IonQ. These advancements demonstrate NVIDIA's ongoing leadership in supercomputing and quantum computing, respectively, contributing positively to the company's positioning. Additionally, despite broader market fluctuations and uncertainties related to geopolitical trade talks, NVIDIA’s recent earnings report showing strong sales and net income bolstered investor confidence. During the last quarter, NVIDIA experienced a 31% price increase, reflecting the combination of these developments and aligning with general optimism in the tech sector, as indicated by the rise in key indexes like the Nasdaq Composite.

Every company has risks, and we've spotted 1 risk for NVIDIA you should know about.

The recent advances in NVIDIA's supercomputing and quantum computing sectors, including the launch of the JUPITER supercomputer and collaboration with IonQ, are expected to bolster NVIDIA's position in these high-growth areas. This news complements the company's strategic pivot toward AI model scaling and portends potential revenue enhancements from increased AI workload demands. However, regulatory challenges and export controls could pose risks, particularly in maintaining diversified revenue streams across key markets like China.

Over the past five years, NVIDIA's total shareholder returns, including share price and dividends, have risen by a very large percentage, reflecting investor enthusiasm for its innovations and growth prospects. This compares favorably to the broader market benchmarks over the past year, where NVIDIA's share price outpaced the US Semiconductor industry growth rate.

NVIDIA's strategic collaborations with Toyota and Uber could positively impact future revenue and earnings forecasts, particularly in the automotive sector. Analysts anticipate NVIDIA's revenue to grow annually by 30.3% over the next three years, with some potential margin contraction. With the share price currently at US$113.54, there is a 20.6% discount to the consensus price target of US$163.12, suggesting room for appreciation if NVIDIA meets or exceeds these expectations.

Examine NVIDIA's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives