- United States

- /

- Electrical

- /

- NYSE:SMR

NuScale Power (SMR) Gains 174% Over Last Quarter

Reviewed by Simply Wall St

NuScale Power (SMR) has made significant strides over the last quarter, marked by a remarkable 174% increase in its share price. The company's recent announcements, including a collaboration with GSE Solutions for developing a hydrogen fuel cell generation model and a strategic agreement with Paragon Energy Solutions for advanced monitoring and safety systems, underscore its innovative efforts in integrated energy systems. These developments align with the broader market trends, potentially amplifying NuScale's market position amid an 11% annual rise. Such initiatives, along with the appointment of a new Chief Legal Officer, may have positively influenced investor sentiment.

We've identified 4 weaknesses for NuScale Power that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent announcements from NuScale Power, including collaborations with GSE Solutions and Paragon Energy Solutions, bolster its position in the competitive energy market. These initiatives align with the company's focus on accelerating SMR commercialization and could enhance revenue growth and market presence. The total shareholder return, including share price appreciation and dividends, reached a remarkable 309.73% over the past three years, highlighting significant long-term investor gains. Over the last year, NuScale's performance outstripped both the US Electrical industry, which saw a 31.6% return, and the broader US Market's 11.4% return. Such results reflect strong investor confidence amid ongoing industry advancements.

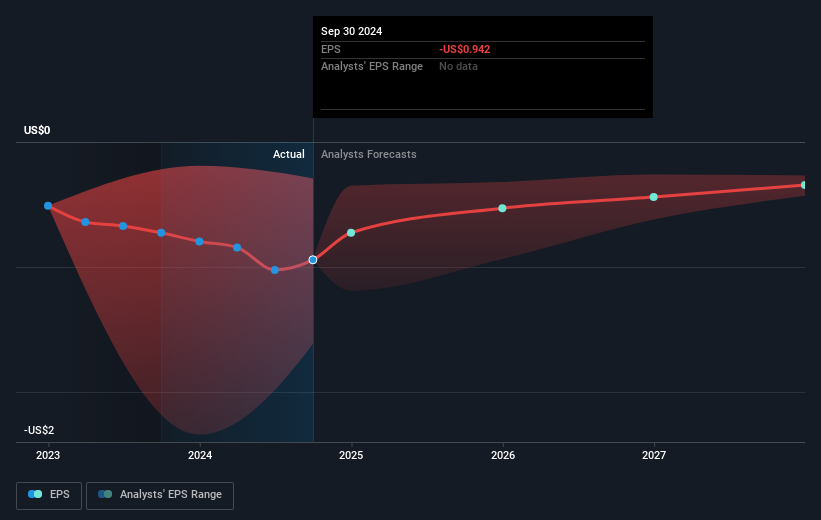

The innovative steps could positively impact future revenue and earnings forecasts, aligning with analysts' expectations of substantial growth. However, despite the recent share price surge to US$42.12, the current valuation is above the consensus analyst price target of US$37.59, implying potential overvaluation. Investors might need to reassess market assumptions, particularly considering the anticipated revenue growth rate exceeding the market average at 45.5% per year, despite projected losses over the next three years. The company's strategic collaborations and aggressive advancements in SMR technology underscore its potential to enhance future revenue, despite persistent profitability challenges and a high earnings multiple needed to justify current valuations.

Evaluate NuScale Power's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives