- Canada

- /

- Metals and Mining

- /

- TSXV:NBY

Niobay Metals And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian stock market continues to hit fresh highs, buoyed by trade optimism and solid corporate earnings, investors are navigating a landscape of elevated valuations and potential volatility. The term 'penny stocks' might sound outdated, but these smaller or newer companies can still offer significant opportunities when backed by strong financials. In this context, we'll explore several penny stocks that combine financial strength with growth potential, making them intriguing options for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$66.76M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.71 | CA$169.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.75 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.91 | CA$18.04M | ✅ 2 ⚠️ 4 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.83 | CA$104.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.74 | CA$185.26M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.21M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.58 | CA$9.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 452 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Niobay Metals (TSXV:NBY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Niobay Metals Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada with a market cap of CA$11.94 million.

Operations: Niobay Metals Inc. currently does not report any revenue segments.

Market Cap: CA$11.94M

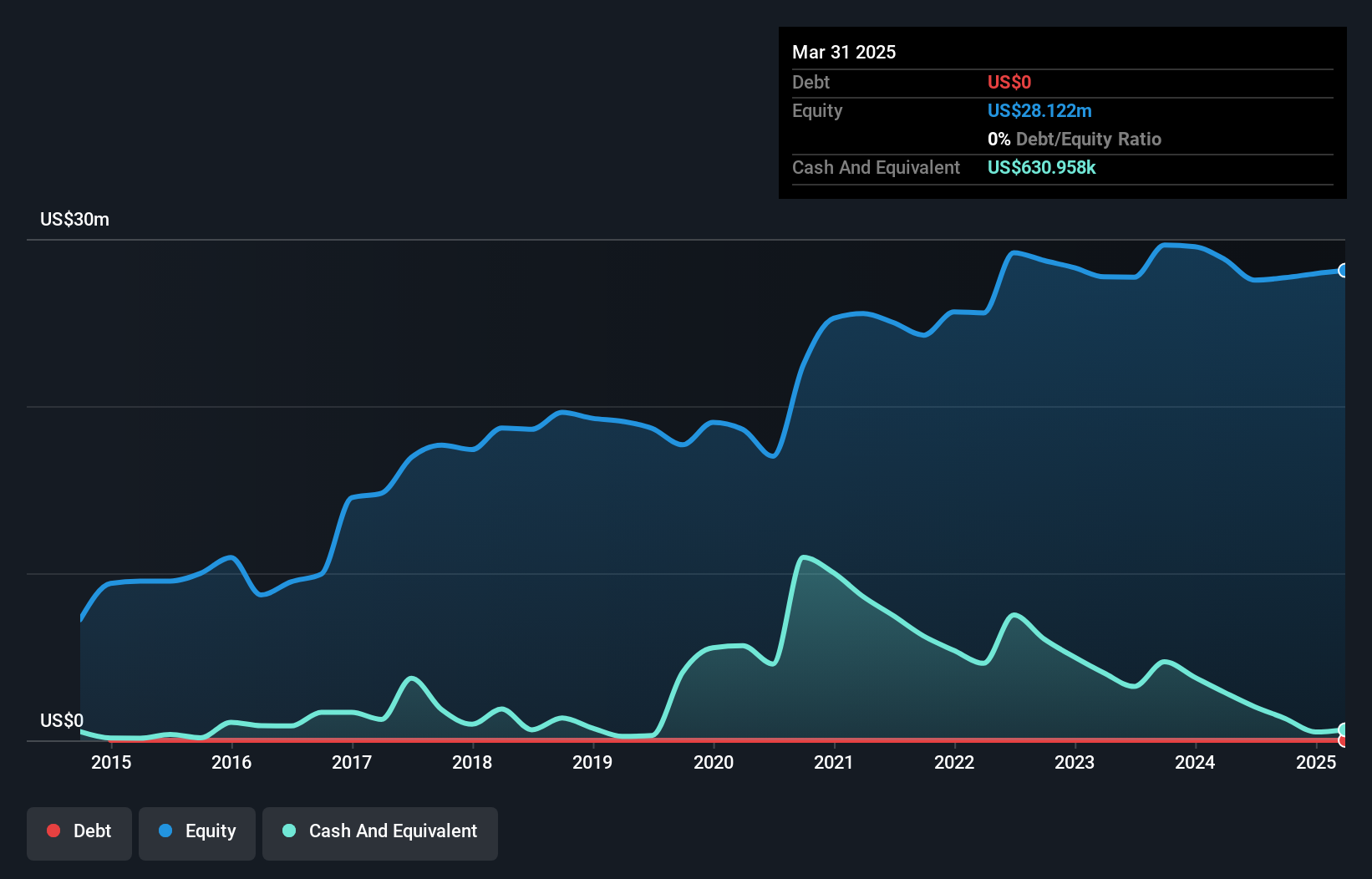

Niobay Metals Inc., with a market cap of CA$11.94 million, is a pre-revenue company focused on mineral exploration in Canada. Despite being debt-free and having an experienced board, it faces challenges such as less than one year of cash runway and high share price volatility. Recent activities include a non-brokered private placement raising CA$2.24 million and the initiation of a large-scale drilling campaign at the Crevier property supported by government grants. The company also made its first product deliveries from its pilot plant, aiming to meet specifications for potential customers in the niobium and tantalum markets.

- Navigate through the intricacies of Niobay Metals with our comprehensive balance sheet health report here.

- Gain insights into Niobay Metals' past trends and performance with our report on the company's historical track record.

Pulse Oil (TSXV:PUL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pulse Oil Corp. focuses on the exploration and production of crude oil, natural gas, and natural gas liquids in Alberta with a market cap of CA$9.35 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to CA$4.41 million.

Market Cap: CA$9.35M

Pulse Oil Corp., with a market cap of CA$9.35 million, operates in Alberta's oil and gas sector but remains unprofitable despite generating CA$4.69 million in revenue for 2024. The company recently secured CA$2.25 million through loan agreements to fund its Bigoray enhanced oil recovery project, which involves solvent injection starting Q2 2025. Despite having no debt and a seasoned management team, Pulse faces high share price volatility and going concern doubts from auditors due to ongoing losses and short-term liabilities exceeding assets by CA$0.1 million, raising concerns about its financial stability amidst operational challenges.

- Click to explore a detailed breakdown of our findings in Pulse Oil's financial health report.

- Examine Pulse Oil's past performance report to understand how it has performed in prior years.

TriStar Gold (TSXV:TSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TriStar Gold, Inc. focuses on acquiring, exploring, and developing precious metal prospects in the Americas with a market cap of CA$52.64 million.

Operations: TriStar Gold, Inc. does not report any revenue segments.

Market Cap: CA$52.64M

TriStar Gold, Inc., with a market cap of CA$52.64 million, remains pre-revenue as it focuses on advancing its Castelo de Sonhos project in Brazil. Despite being debt-free and having short-term assets exceeding liabilities, the company faces challenges such as a negative return on equity and limited cash runway. Recent capital raising efforts through private placements have bolstered financial resources, but management's inexperience may pose risks. The updated prefeasibility study for Castelo de Sonhos outlines economic parameters based on a gold price of US$2,200/oz and highlights potential operational plans for an open pit mine with high metallurgical recovery rates.

- Jump into the full analysis health report here for a deeper understanding of TriStar Gold.

- Explore historical data to track TriStar Gold's performance over time in our past results report.

Key Takeaways

- Click through to start exploring the rest of the 449 TSX Penny Stocks now.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niobay Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBY

Niobay Metals

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Flawless balance sheet moderate.

Market Insights

Community Narratives