- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NasdaqGS:NFLX) Unveils Immersive Netflix House Locations in Philadelphia and Dallas

Reviewed by Simply Wall St

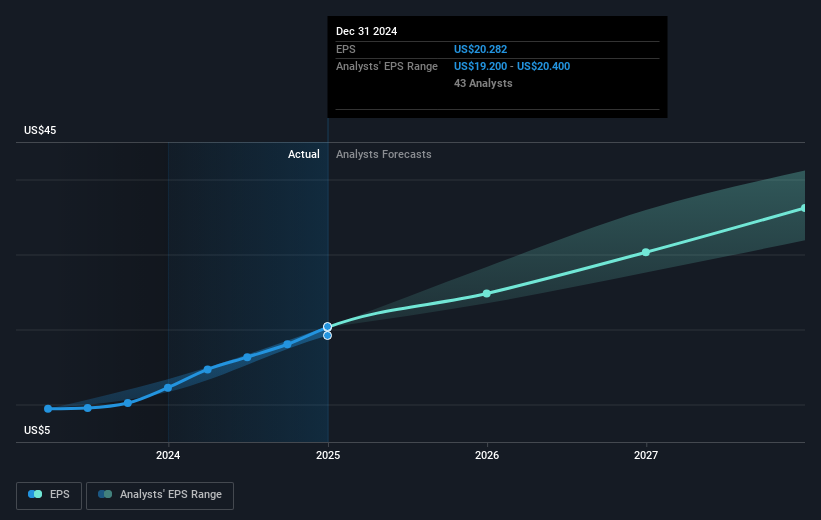

Netflix (NasdaqGS:NFLX) recently announced its expansion into physical locations with Netflix House, offering immersive experiences based on popular shows. This initiative is likely aligned with its broader strategy to enhance brand engagement beyond streaming. Over the last quarter, Netflix's shares rose by 27.22%, amidst a flat market performance. During this period, geopolitical tensions and upcoming Federal Reserve decisions contributed to volatility across markets. Netflix's collaboration with Balaji Telefilms and encouraging financial projections may have added weight to its share price movement, which significantly outpaced tech sector indices, such as Nasdaq, given its 0.5% gain.

Buy, Hold or Sell Netflix? View our complete analysis and fair value estimate and you decide.

The introduction of Netflix House signals a significant move towards diversifying revenue streams beyond digital content. This expansion into physical locations creates an opportunity for increased consumer engagement, potentially boosting their merchandising and ancillary revenues. This initiative supports the company's broader growth strategies as highlighted in analyst narratives focusing on global ad tech and gaming. As Netflix continues to broaden its market footprint, such ventures may influence future revenue and earnings positively, aligning with forecasts of 12% annual revenue growth.

Over a three-year period, Netflix delivered a very large total shareholder return of 614.22%, highlighting robust long-term performance despite the volatility in the market. This performance contrasts with the past year's scenario where Netflix's share appreciation significantly surpassed the US market's 9.8% return and the US Entertainment industry's 60.6% return.

However, the current share price of US$1,137.69 reflects a 3.7% premium over the consensus analyst price target of US$1,096.58. This suggests that market enthusiasm might be slightly ahead of analyst expectations, potentially pricing in assumed future growth or uncertainties around implementing new initiatives such as physical locations. The market's response to these ventures will be crucial in validating the bullish projections detailed in analysts' revenue and earnings growth forecasts.

Navigate through the intricacies of Netflix with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives