Most stock markets in the Middle East have recently shown gains, buoyed by investor optimism surrounding potential U.S. interest rate cuts. In this context, penny stocks remain an intriguing area for investors seeking opportunities beyond the mainstream market players. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still provide significant value and growth potential when they are backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.77 | SAR2.15B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.76 | SAR1.5B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.976 | ₪354.34M | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.07 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.07 | AED13.05B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.811 | AED493.29M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.772 | ₪217.6M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions both in the United Arab Emirates and internationally, with a market cap of AED344 million.

Operations: The company's revenue is primarily derived from its life insurance segment, generating AED80.30 million, and its medical insurance segment, contributing AED25.36 million.

Market Cap: AED344M

HAYAH Insurance Company P.J.S.C. operates in the Middle East with a market cap of AED344 million, deriving revenue mainly from life and medical insurance segments. Despite being unprofitable, with a net loss of AED3.02 million for the first half of 2025, HAYAH maintains financial stability through its debt-free status and sufficient cash runway exceeding three years. The company’s short-term assets surpass both its short- and long-term liabilities, providing some financial cushion amid volatility in share price. While losses have increased over five years, management's experience offers potential for strategic navigation through current challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of HAYAH Insurance Company P.J.S.C.

- Explore historical data to track HAYAH Insurance Company P.J.S.C's performance over time in our past results report.

Sanica Isi Sanayi (IBSE:SNICA)

Simply Wall St Financial Health Rating: ★★★★★☆

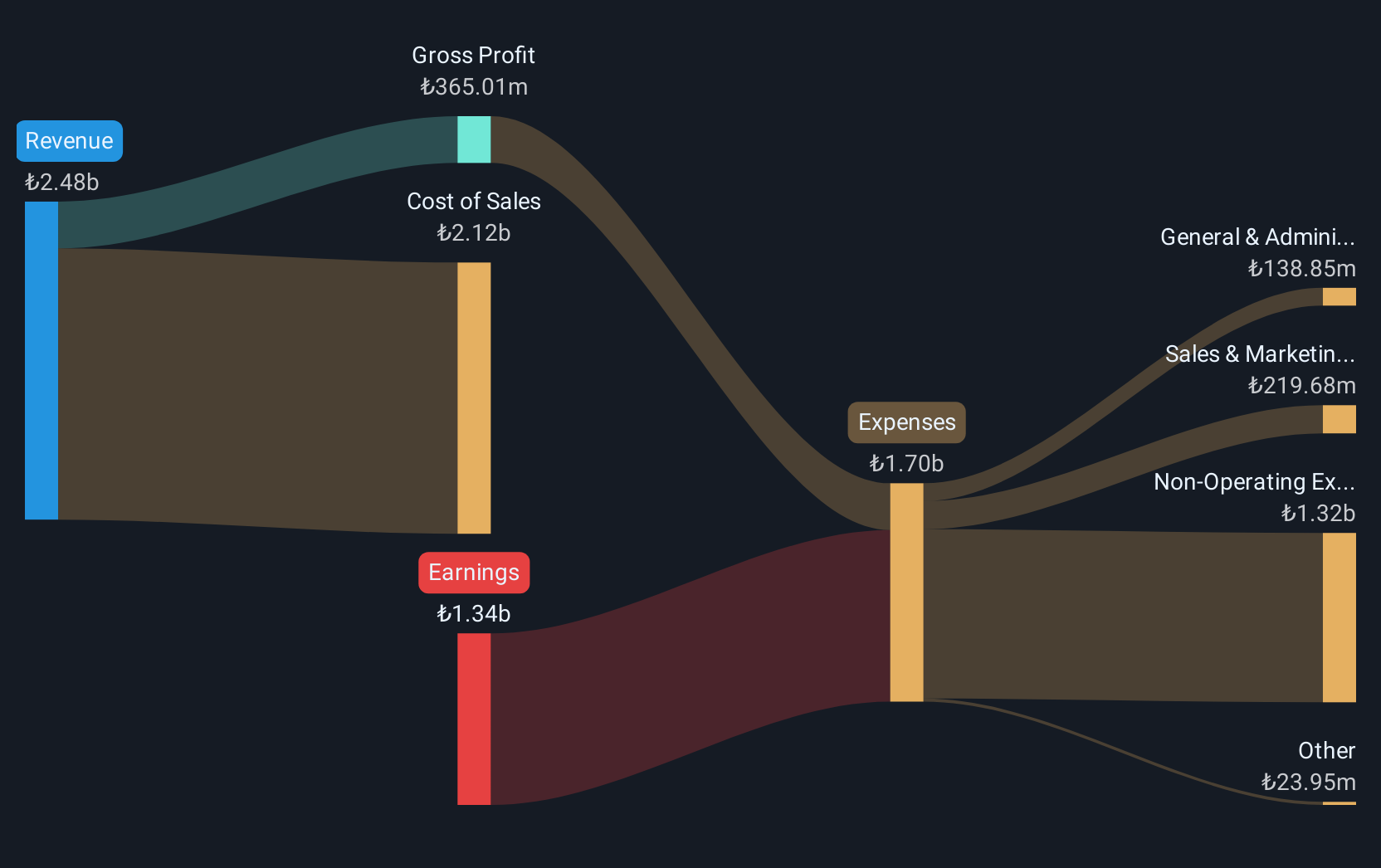

Overview: Sanica Isi Sanayi A.S. operates in Turkey, offering radiators, combi boilers, and related products, with a market cap of TRY2.95 billion.

Operations: The company generates revenue from its Building Products segment, amounting to TRY2.22 billion.

Market Cap: TRY2.95B

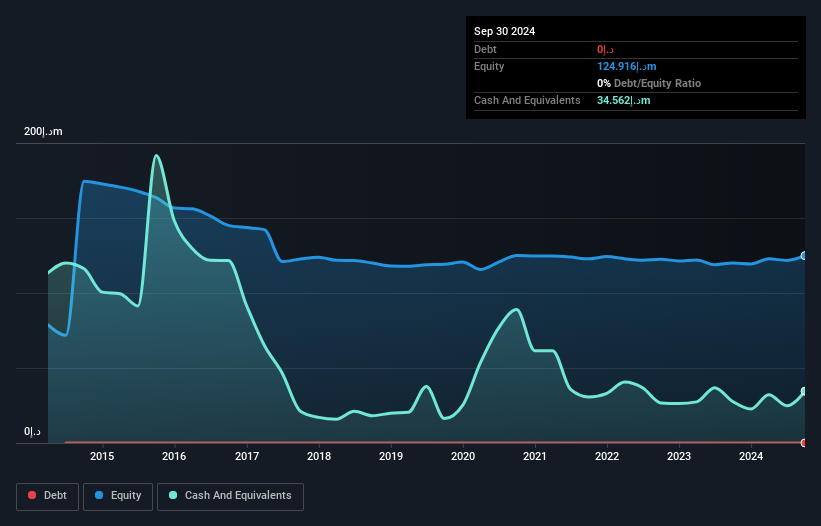

Sanica Isi Sanayi A.S., with a market cap of TRY2.95 billion, faces financial challenges as it remains unprofitable, reporting a net loss of TRY139.7 million for Q2 2025 compared to the previous year's profit. Despite declining sales and increasing losses over five years, its debt management shows improvement; the debt-to-equity ratio decreased from 78.1% to 36.1%. The company's short-term assets of TRY3.4 billion comfortably cover both short- and long-term liabilities, offering some financial resilience amid operating cash flow that adequately covers its debt obligations. However, ongoing volatility and negative return on equity highlight risks for potential investors in this penny stock environment.

- Dive into the specifics of Sanica Isi Sanayi here with our thorough balance sheet health report.

- Gain insights into Sanica Isi Sanayi's past trends and performance with our report on the company's historical track record.

Matricelf (TASE:MTLF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Matricelf Ltd (TASE:MTLF) is a biotechnology company focused on developing a platform for autologous tissue engineering to address various medical conditions, with a market cap of ₪67.56 million.

Operations: Matricelf Ltd does not currently report any revenue segments.

Market Cap: ₪67.56M

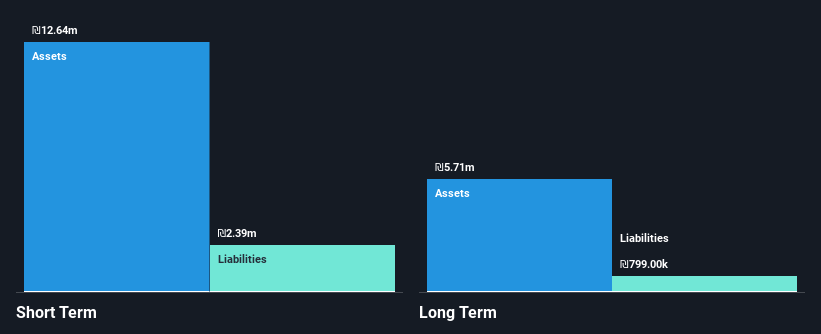

Matricelf Ltd, with a market cap of ₪67.56 million, operates as a pre-revenue biotechnology company. Despite its lack of revenue, the company's short-term assets of ₪5.8 million exceed both its short- and long-term liabilities, indicating some financial stability in the near term. Matricelf remains debt-free and has not experienced shareholder dilution over the past year; however, it faces challenges with less than a year of cash runway and increasing losses at 15.4% annually over five years. The management team is seasoned with an average tenure of 4.3 years but must navigate high share price volatility and negative return on equity (-218.2%).

- Get an in-depth perspective on Matricelf's performance by reading our balance sheet health report here.

- Gain insights into Matricelf's historical outcomes by reviewing our past performance report.

Key Takeaways

- Access the full spectrum of 79 Middle Eastern Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SNICA

Sanica Isi Sanayi

Provides radiators, combi boilers, and other related products in Turkey.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives