- Israel

- /

- Commercial Services

- /

- TASE:UTRN

Middle Eastern Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently been under pressure due to geopolitical tensions, with indices across the region experiencing declines. Despite this backdrop, investors continue to seek opportunities in less conventional areas of the market. Penny stocks, though a somewhat outdated term, still hold potential for growth by offering access to smaller or newer companies that may be overlooked by larger investors. In this article, we will explore three penny stocks that stand out for their financial strength and potential for long-term success amidst current market conditions.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Terminal X Online (TASE:TRX) | ₪4.248 | ₪539.52M | ✅ 2 ⚠️ 0 View Analysis > |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.719 | ₪12.49M | ✅ 1 ⚠️ 4 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.75 | SAR1.59B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪3.97 | ₪278.59M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.68 | TRY1.81B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.24 | AED375.38M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.39 | AED10.16B | ✅ 3 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.72 | AED437.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.211 | ₪164.37M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Formet Metal ve Cam Sanayi (IBSE:FORMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Formet Metal ve Cam Sanayi A.S. manufactures and sells steel doors primarily in Turkey, with a market cap of TRY2 billion.

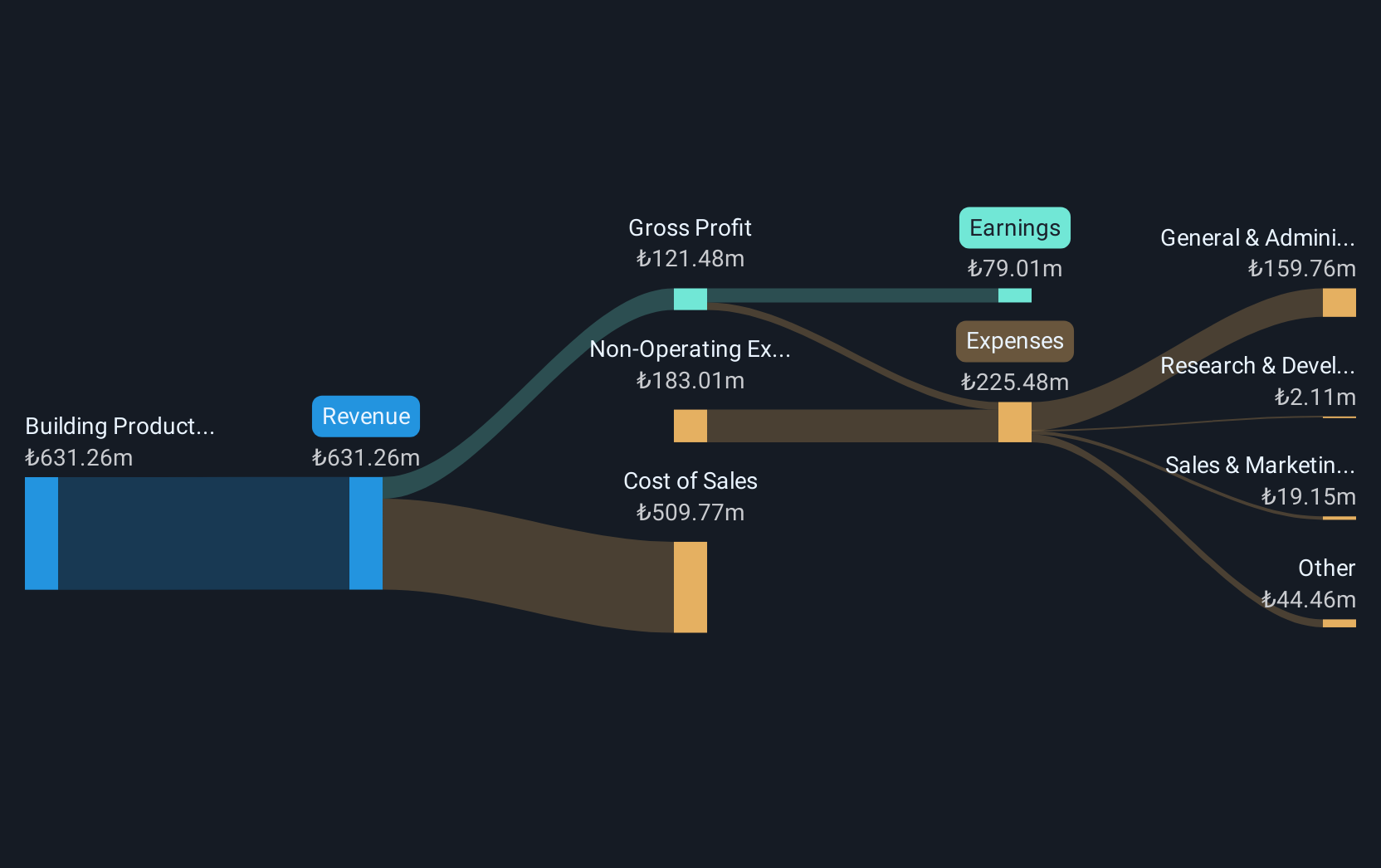

Operations: The company generates revenue from its Building Products segment, totaling TRY631.26 million.

Market Cap: TRY2B

Formet Metal ve Cam Sanayi A.S. has shown a turnaround by becoming profitable over the past year, reporting a net income of TRY98.41 million for Q1 2025 compared to a loss previously. The company maintains a satisfactory net debt to equity ratio of 23.4% and has reduced its debt significantly over five years, enhancing financial stability. However, recent earnings were influenced by one-off gains and the board lacks seasoned experience with an average tenure of just one year. The company's short-term assets notably exceed both short-term and long-term liabilities, providing some financial cushion amidst market volatility.

- Navigate through the intricacies of Formet Metal ve Cam Sanayi with our comprehensive balance sheet health report here.

- Understand Formet Metal ve Cam Sanayi's track record by examining our performance history report.

Pulsenmore (TASE:PULS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulsenmore Ltd. provides self-scan ultrasound devices for remote clinical diagnosis and screening, with a market cap of ₪96.97 million.

Operations: The company's revenue is derived entirely from its X-Ray Equipment segment, amounting to ₪9.66 million.

Market Cap: ₪96.97M

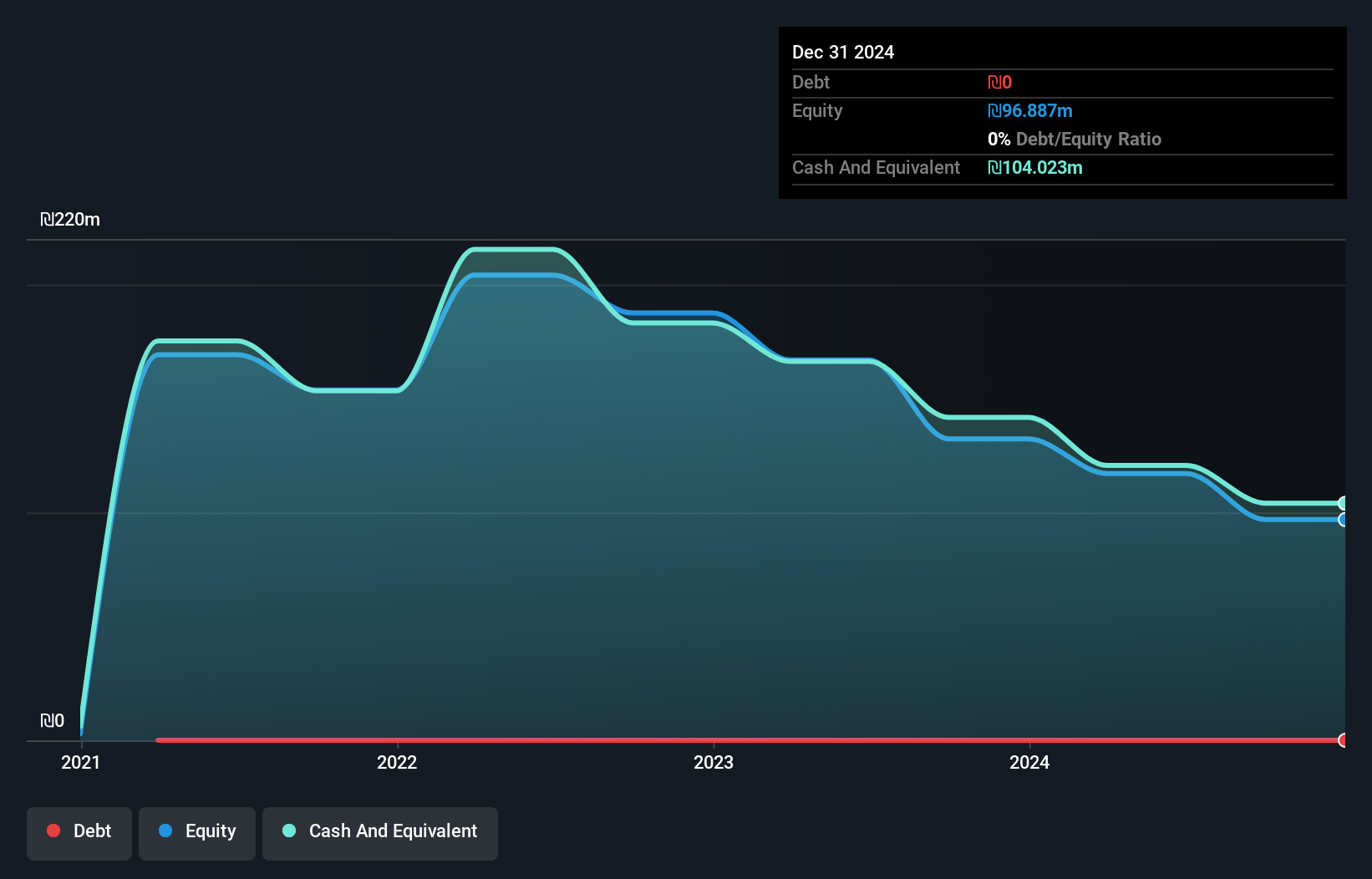

Pulsenmore Ltd., with a market cap of ₪96.97 million, is currently unprofitable and has experienced increasing losses over the past five years at 30.2% annually. Despite this, the company remains debt-free and possesses short-term assets of ₪132.4 million that comfortably cover its liabilities, providing some financial stability. The management and board are considered experienced, although the share price has been highly volatile recently. Pulsenmore reported sales of ₪9.66 million for 2024 but will be delisted from OTC Equity due to inactivity on May 19, 2025, highlighting challenges in maintaining market presence amidst financial struggles.

- Click here and access our complete financial health analysis report to understand the dynamics of Pulsenmore.

- Examine Pulsenmore's past performance report to understand how it has performed in prior years.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions with a market cap of ₪89.22 million.

Operations: The company's revenue is derived from its Heavy Construction segment, totaling ₪89.61 million.

Market Cap: ₪89.22M

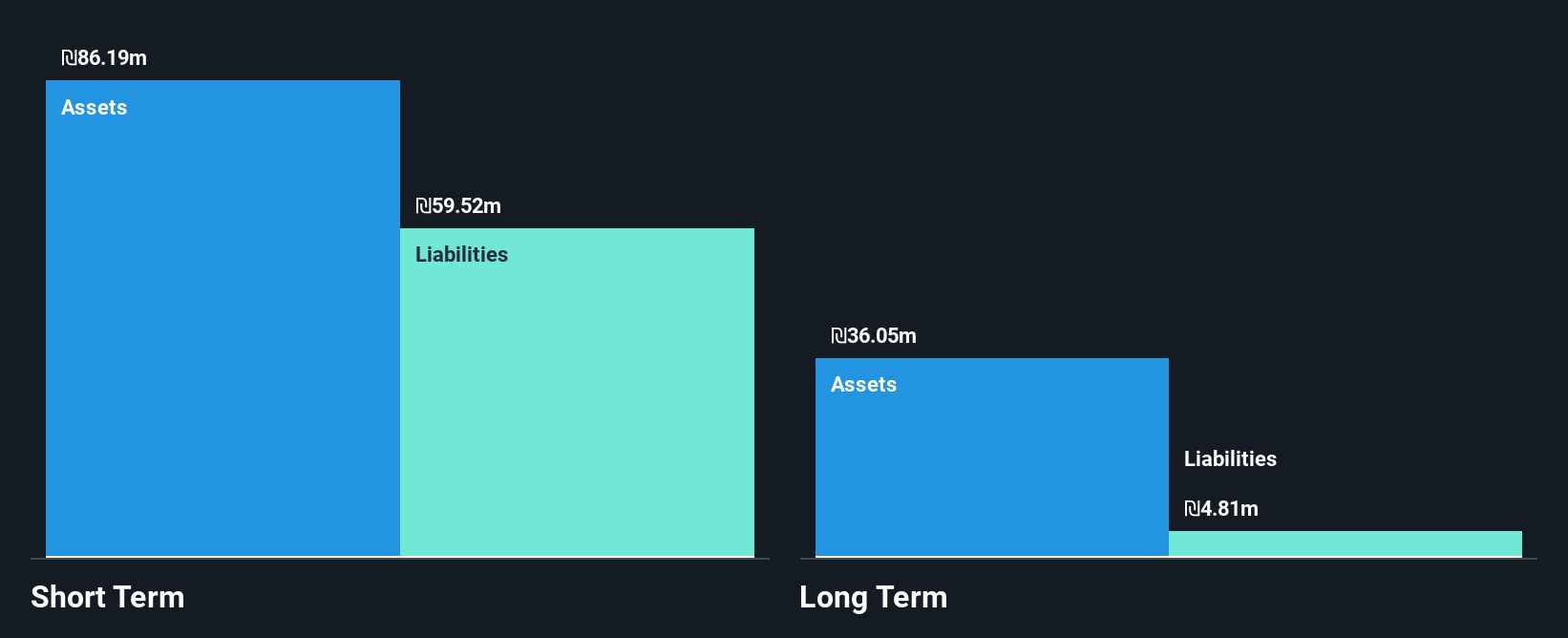

Utron Ltd., with a market cap of ₪89.22 million, is trading significantly below its estimated fair value, suggesting potential undervaluation. The company's short-term assets of ₪86.2 million comfortably cover both its short- and long-term liabilities, indicating sound financial management despite recent earnings decline and low profit margins (0.2%). Utron's debt levels are well-managed with cash exceeding total debt and operating cash flow covering 272.6% of it. However, the return on equity remains low at 0.3%, and interest payments are not well-covered by EBIT, which could pose challenges if profitability doesn't improve soon.

- Click here to discover the nuances of Utron with our detailed analytical financial health report.

- Learn about Utron's historical performance here.

Key Takeaways

- Unlock our comprehensive list of 96 Middle Eastern Penny Stocks by clicking here.

- Curious About Other Options? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:UTRN

Utron

Engages in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions.

Adequate balance sheet and fair value.

Market Insights

Community Narratives