Amidst a backdrop of U.S. inflation concerns and rate uncertainty, most Gulf markets have recently experienced downward trends, with notable declines in key indices such as Saudi Arabia's benchmark index. Despite these challenges, the Middle Eastern financial landscape continues to offer intriguing opportunities for investors willing to explore beyond traditional stocks. Penny stocks, though often considered niche investments, can still present significant growth potential when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.399 | ₪14.85M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.15 | SAR1.66B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.058 | ₪285.4M | ✅ 4 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.17 | AED2.34B | ✅ 4 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.98 | TRY2.13B | ✅ 2 ⚠️ 1 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.27 | AED676.89M | ✅ 0 ⚠️ 4 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED398.48M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.82 | AED12.08B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.801 | AED487.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.633 | ₪195.74M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 75 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Phoenix Group (ADX:PHX)

Simply Wall St Financial Health Rating: ★★★★★☆

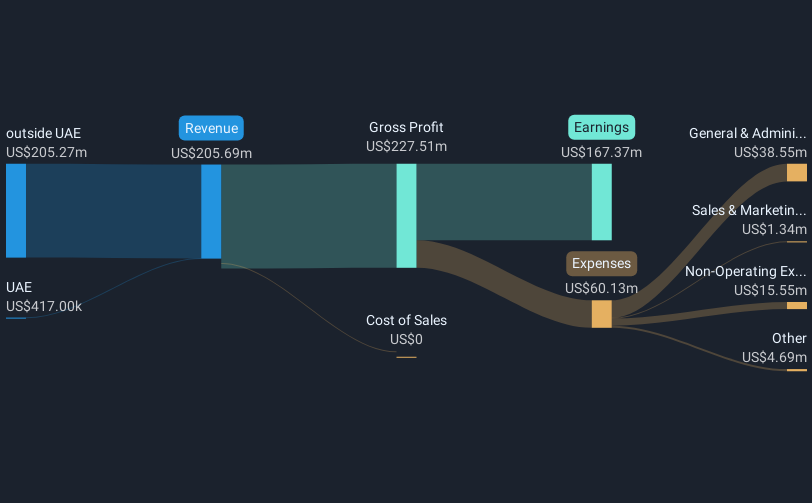

Overview: Phoenix Group Plc, along with its subsidiaries, offers crypto and cloud mining services across the United Arab Emirates, Oman, CIS, Canada, the United States, and internationally with a market cap of AED9.74 billion.

Operations: Phoenix Group's revenue is generated from its data processing segment, totaling $168.01 million.

Market Cap: AED9.74B

Phoenix Group Plc, a significant entity in the crypto and cloud mining sector, has recently expanded its operations in Ethiopia by securing an additional 52 MW of mining capacity. This move increases its global capacity to over 500 MW across five countries, reinforcing its position among the top Bitcoin miners globally. Despite this growth, Phoenix reported a net loss of US$153.6 million for Q1 2025, contrasting with a net income from the previous year. The company maintains satisfactory debt levels and strong short-term asset coverage but remains unprofitable with negative return on equity at -6.98%.

- Jump into the full analysis health report here for a deeper understanding of Phoenix Group.

- Gain insights into Phoenix Group's future direction by reviewing our growth report.

Union Properties (DFM:UPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

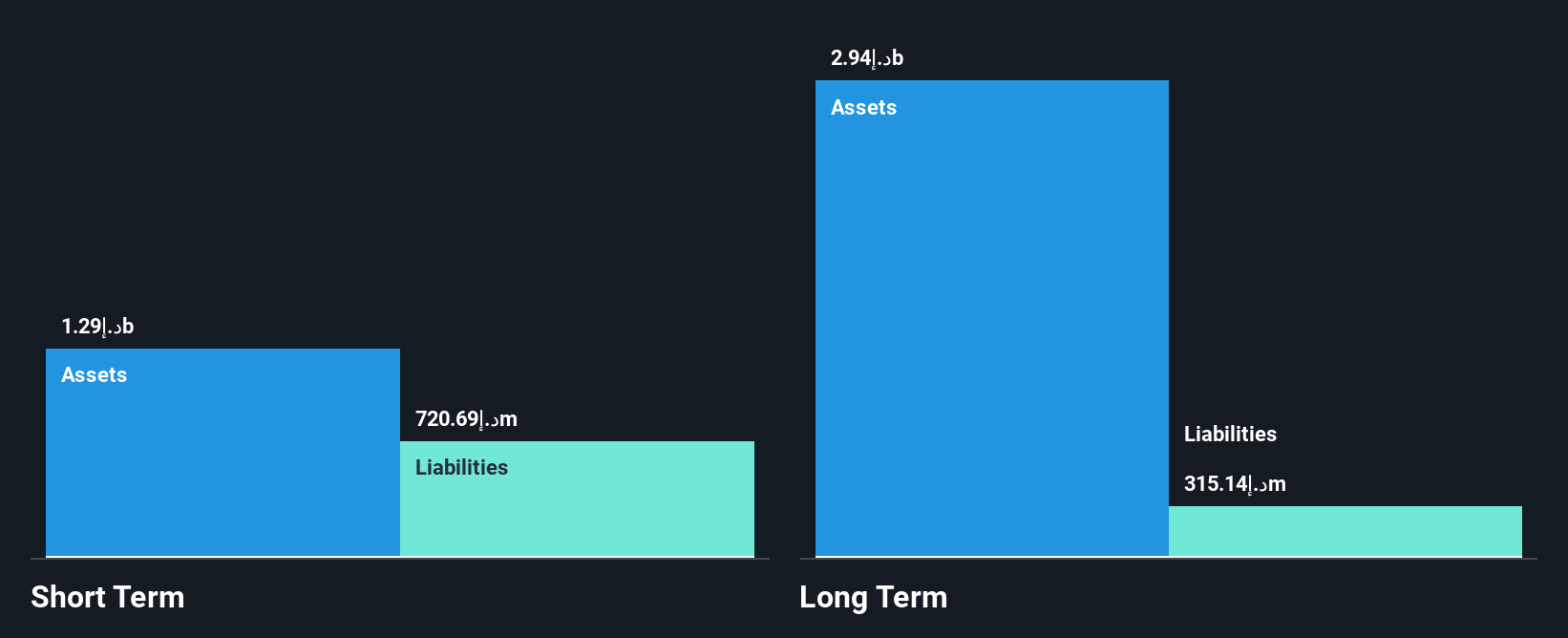

Overview: Union Properties (ticker: DFM:UPP) is a company that invests in and develops properties, with a market capitalization of AED3.80 billion.

Operations: The company's revenue is derived from three main segments: Contracting (AED29.39 million), Real Estate (AED54.50 million), and Goods and Services (AED469.97 million).

Market Cap: AED3.8B

Union Properties has shown financial resilience with its short-term assets of AED1.3 billion exceeding both long and short-term liabilities, indicating robust liquidity. Despite a reduction in net income to AED5.81 million for Q1 2025 compared to the previous year, the company maintains a satisfactory net debt to equity ratio of 8.3%. However, challenges persist with negative operating cash flow and high share price volatility over recent months. The company's earnings growth forecast at 26.41% per year offers potential upside, though past performance reflects significant one-off items affecting results and lower profit margins than last year.

- Take a closer look at Union Properties' potential here in our financial health report.

- Explore Union Properties' analyst forecasts in our growth report.

Alarum Technologies (TASE:ALAR)

Simply Wall St Financial Health Rating: ★★★★★★

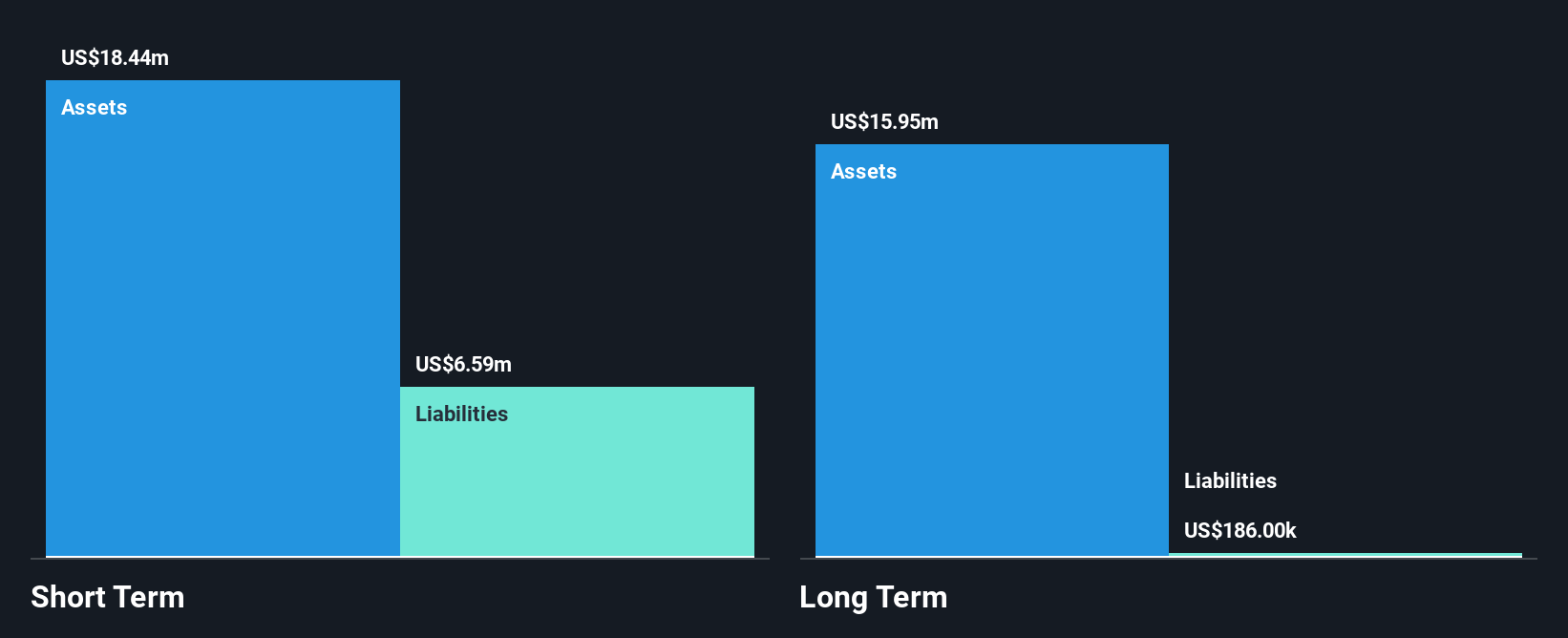

Overview: Alarum Technologies Ltd. offers web data collection solutions across various regions, including the Americas, Europe, Southeast Asia, the Middle East, and Africa, with a market cap of ₪285.40 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: ₪285.4M

Alarum Technologies Ltd. has demonstrated financial stability, with short-term assets of $18.4M surpassing both short and long-term liabilities, underscoring strong liquidity. The company recently updated its Q2 2025 revenue guidance to an estimated $8.8M ±3%, reflecting improved expectations despite a decline in Q1 sales to US$7.13 million from the previous year. Alarum's debt is well-covered by operating cash flow, and it maintains more cash than total debt, highlighting effective financial management. However, high share price volatility remains a concern for investors considering this penny stock's potential risks and rewards in the Middle East market landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of Alarum Technologies.

- Review our growth performance report to gain insights into Alarum Technologies' future.

Where To Now?

- Navigate through the entire inventory of 75 Middle Eastern Penny Stocks here.

- Looking For Alternative Opportunities? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ALAR

Alarum Technologies

Provides web data collection solutions in North, South, and Central America, Europe, Southeast Asia, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives