- United States

- /

- Construction

- /

- NasdaqGS:MTRX

Matrix Service (NASDAQ:MTRX) Seems To Use Debt Rather Sparingly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Matrix Service Company (NASDAQ:MTRX) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Matrix Service

What Is Matrix Service's Net Debt?

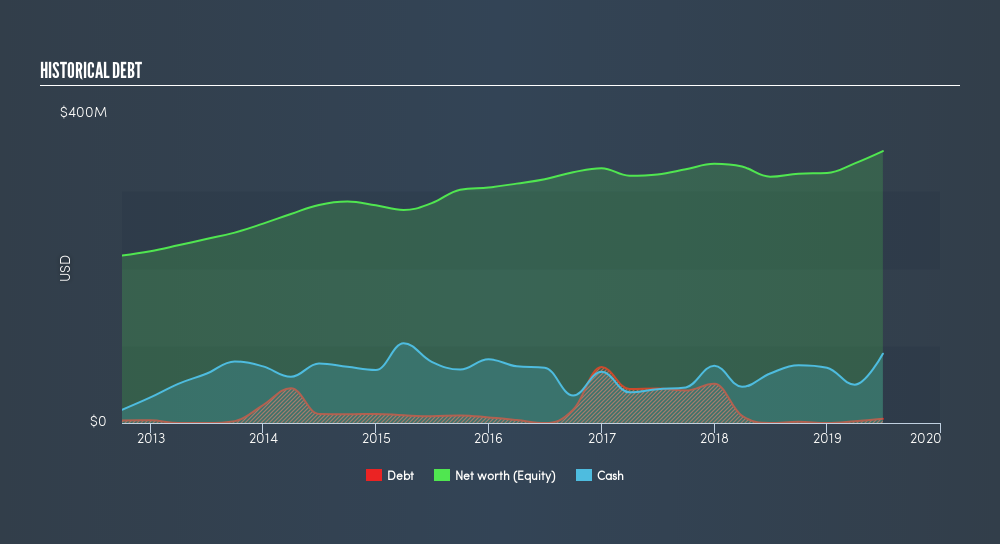

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Matrix Service had US$5.35m of debt, an increase on , over one year. But it also has US$89.7m in cash to offset that, meaning it has US$84.4m net cash.

How Healthy Is Matrix Service's Balance Sheet?

The latest balance sheet data shows that Matrix Service had liabilities of US$275.5m due within a year, and liabilities of US$5.94m falling due after that. Offsetting this, it had US$89.7m in cash and US$314.5m in receivables that were due within 12 months. So it actually has US$122.8m more liquid assets than total liabilities.

This surplus suggests that Matrix Service is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Matrix Service boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Matrix Service grew its EBIT by 404% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Matrix Service can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Matrix Service has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Matrix Service recorded free cash flow worth a fulsome 91% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Matrix Service has net cash of US$84.4m, as well as more liquid assets than liabilities. The cherry on top was that in converted 91% of that EBIT to free cash flow, bringing in US$11m. When it comes to Matrix Service's debt, we sufficiently relaxed that our mind turns to the jacuzzi. Another factor that would give us confidence in Matrix Service would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MTRX

Matrix Service

Provides engineering, fabrication, construction, and maintenance services to support critical energy infrastructure and industrial markets in the United States, Canada, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.