- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Lowe's Companies (NYSE:LOW) Partners With MrBeast To Launch Interactive Creator Network

Reviewed by Simply Wall St

Lowe's Companies (NYSE:LOW) has introduced the first home improvement creator network, aiming to empower DIY creators and enhance community engagement. This network, featuring partnerships like the one with MrBeast, reflects a focus on connecting with younger audiences, which aligns with a broader market trend. The company's share price, which remained flat over the last month, may not reflect significant changes from these initiatives alone. Broader market movements, marked by moderate gains in indices and investor optimism surrounding US-China trade talks, likely weighed more strongly on Lowe's recent stock performance.

Lowe's introduction of the first home improvement creator network, complemented by partnerships with influencers like MrBeast, could invigorate engagement with younger audiences and potentially influence revenue growth. The integration of such initiatives aligns with Lowe’s Total Home Strategy, aiming to enhance community engagement and boost Pro market penetration. These efforts may lead to increased revenue through greater DIY activity and elevated customer loyalty, possibly driving earnings higher as well. However, achieving notable financial outcomes relies on the successful engagement of the target demographic and conversion of this digital presence into tangible sales figures.

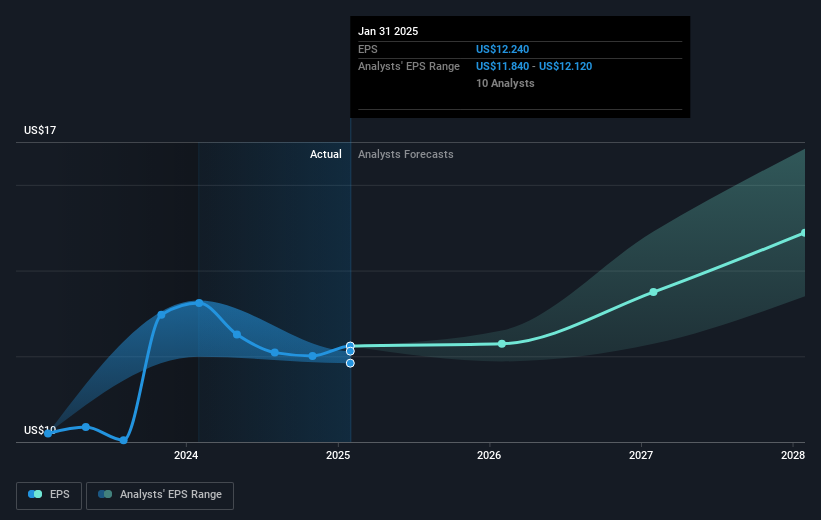

Over the past five years, Lowe's total return, including share price and dividends, reached 91.37%, indicating strong performance, although its recent annual performance was weaker compared to the US Specialty Retail industry average of 12.7%. Within the last year, Lowe's experienced a 5.3% decline in earnings growth, highlighting some challenges in maintaining momentum.

The current share price stands at US$223.01, with a consensus analyst price target of US$272.95, suggesting a potential upside of approximately 18.3%. While the price movement remains flat in the short term, understanding the broader strategies and how Lowe's aligns its initiatives with revenue and earnings forecasts will be essential in assessing whether these efforts can close the gap to meet analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives