- Brazil

- /

- Electric Utilities

- /

- BOVESPA:ENBR3

Lacklustre Performance Driving EDP - Energias do Brasil S.A.'s (BVMF:ENBR3) P/E

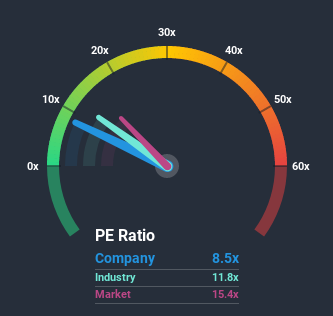

With a price-to-earnings (or "P/E") ratio of 8.5x EDP - Energias do Brasil S.A. (BVMF:ENBR3) may be sending bullish signals at the moment, given that almost half of all companies in Brazil have P/E ratios greater than 16x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

EDP - Energias do Brasil could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for EDP - Energias do Brasil

Is There Any Growth For EDP - Energias do Brasil?

There's an inherent assumption that a company should underperform the market for P/E ratios like EDP - Energias do Brasil's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.7%. Even so, admirably EPS has lifted 150% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 0.9% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 13% per year, which is noticeably more attractive.

In light of this, it's understandable that EDP - Energias do Brasil's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that EDP - Energias do Brasil maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for EDP - Energias do Brasil that you should be aware of.

You might be able to find a better investment than EDP - Energias do Brasil. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade EDP - Energias do Brasil, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EDP - Energias do Brasil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:ENBR3

EDP - Energias do Brasil

EDP - Energias do Brasil S.A. operates in the energy sector in Brazil.

Moderate growth potential second-rate dividend payer.

Market Insights

Community Narratives