- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (KHC) Partners With Live Nation To Elevate Fan Food Experiences

Reviewed by Simply Wall St

The Kraft Heinz Company (KHC) recently announced a multi-year partnership with Live Nation, marking a distinct move to increase its brand presence in U.S. entertainment venues. During the past month, Kraft Heinz experienced a notable price move of 10%, which aligns with broader market optimism reflected in the S&P 500's recent record highs. This partnership, coupled with the executive changes within the company, adds weight to the positive investor sentiment seen across markets. While general economic optimism and strong corporate earnings have been drivers of market performance, Kraft Heinz's initiatives also played a part in this upward momentum, supporting the company's growth trajectory.

We've identified 2 risks for Kraft Heinz that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The partnership between The Kraft Heinz Company and Live Nation could enhance the company's brand presence and consumer engagement, potentially boosting revenue and earnings. By strengthening its foothold in entertainment venues, Kraft Heinz might see increased consumer visibility, which aligns with its long-term marketing and R&D investment strategies. While these initiatives aim to support revenue growth, a price movement of 10% in the past month suggests investor optimism, though the share price of $28.25 is below the consensus price target of $31.28, providing a 10.71% upside potential.

Over the longer term, Kraft Heinz's total shareholder return was 1.72% over five years, a modest gain relative to one-year underperformance compared to the U.S. market, which returned 17.7% during the same shorter period. The U.S. Food industry also experienced an underperformance in the past year, suggesting broader challenges that the company might face. Despite these challenges, positive market sentiment following the new partnership could help mitigate some of the competitive pressures and stimulate future growth.

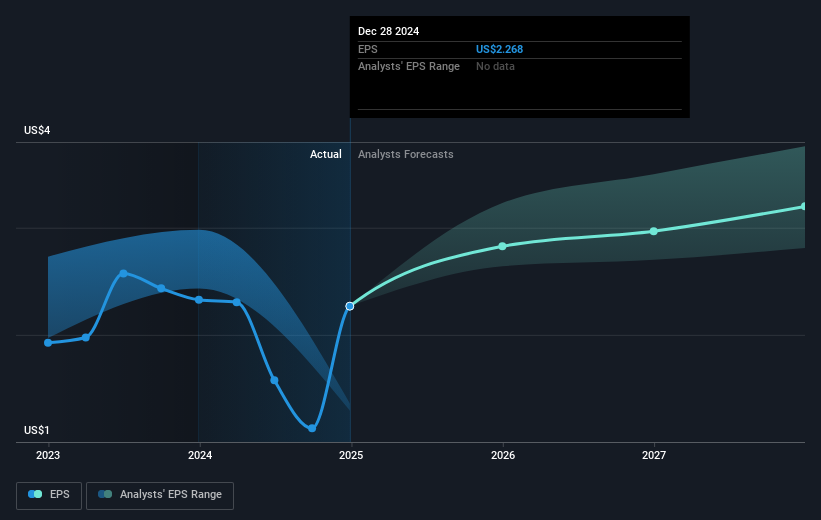

As analysts anticipate a future revenue decrease with a slight increase in profit margins, this new alliance could help Kraft Heinz surpass these expectations if executed effectively. The potential uplift to forecasted earnings of US$3.5 billion by 2028 hinges on successful integration of marketing advancements and brand superiority strategies, as the company navigates both inflationary pressures and promotional cost considerations. Overall, while the partnership sets a promising tone for growth, continuous execution and adaptability remain crucial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives