- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (KMI) Increases Dividend 2% as Earnings Rise in Q2 2025

Reviewed by Simply Wall St

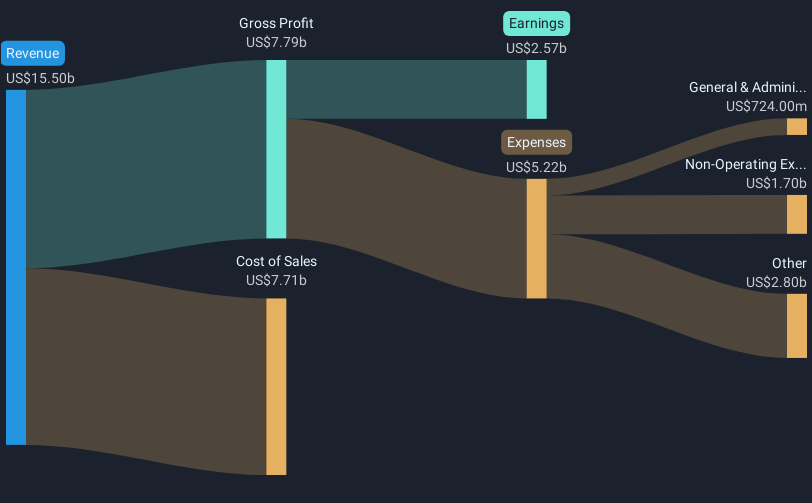

Kinder Morgan (KMI) recently announced a 2% dividend increase and reported strong financial performance in the second quarter of 2025, with sales and net income rising significantly compared to the previous year. Over the last quarter, the company's stock price moved up 3%. This price movement aligns with broader market trends, where major indexes have reached record highs, driven by investor focus on positive earnings reports. Kinder Morgan's strong financial results and dividend increase likely added weight to this upward trend, while the flat market over the last week suggests stability in share valuations amid broader economic conditions.

Kinder Morgan has 2 warning signs we think you should know about.

The recent 2% dividend increase from Kinder Morgan, along with strong financial performance in the second quarter of 2025, may bolster investor confidence in the company's projection for earnings and revenue stability. With Kinder Morgan’s estimates for U.S. natural gas demand driven by LNG exports, the positive financial results indicated in their recent announcements are consistent with this narrative. This could reassure stakeholders regarding future cash flow and earnings stability, even as concerns like declining gas demand and trade tensions persist.

Over the longer five-year period, Kinder Morgan’s shares achieved a total return of 155.44%, including dividends, illustrating significant growth. This performance context becomes more relevant when considering the stock's 1-year return, which was better than the US market and the Oil and Gas industry averages. The company's shares were further bolstered by the recent 3% price increase during the last quarter, aligning with major market segments at record highs, predominantly influenced by positive earnings reports.

Currently trading at US$27.91, Kinder Morgan’s price remains below the consensus price target of US$30.13, suggesting that analysts perceive a moderate upside of approximately 8% from current levels. The ongoing forecast of revenue growth from projects like the Bridge project and strategic acquisitions will further impact financial estimates, contributing to the expectations for an increase in earnings to US$3.6 billion by 2028. As investors assess these developments, Kinder Morgan's efforts to maintain stable earnings through reliable take-or-pay contracts could provide a buffer against market fluctuations.

Learn about Kinder Morgan's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives