Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Karuturi Global Limited (NSE:KGL) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Karuturi Global

What Is Karuturi Global's Debt?

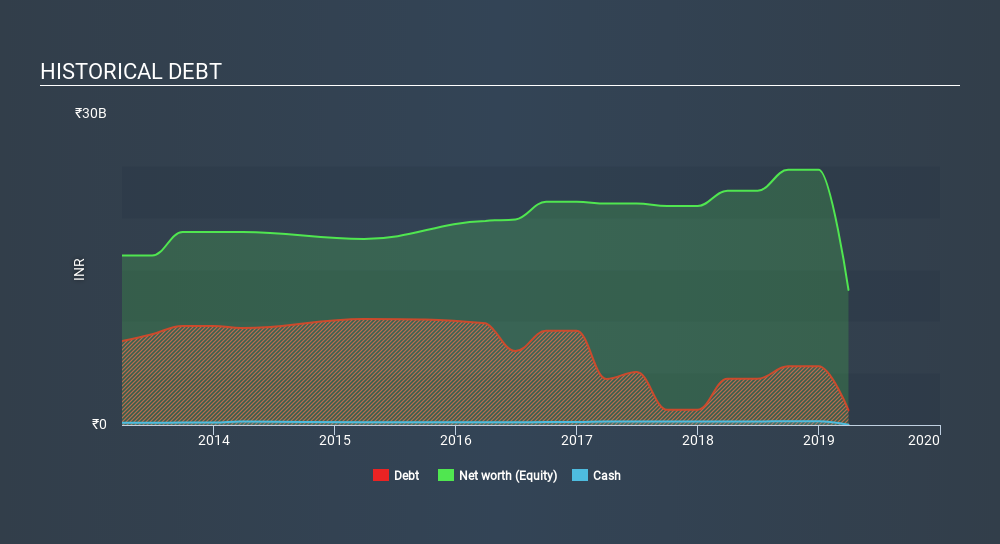

The image below, which you can click on for greater detail, shows that Karuturi Global had debt of ₹1.44b at the end of March 2019, a reduction from ₹4.45b over a year. Net debt is about the same, since the it doesn't have much cash.

A Look At Karuturi Global's Liabilities

According to the last reported balance sheet, Karuturi Global had liabilities of ₹1.93b due within 12 months, and liabilities of ₹395.8m due beyond 12 months. On the other hand, it had cash of ₹14.9m and ₹1.29b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹1.03b.

This deficit casts a shadow over the ₹284.5m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Karuturi Global would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Karuturi Global has a debt to EBITDA ratio of 3.4 and its EBIT covered its interest expense 2.6 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Even worse, Karuturi Global saw its EBIT tank 71% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Karuturi Global will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Karuturi Global generated free cash flow amounting to a very robust 98% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

To be frank both Karuturi Global's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. We're quite clear that we consider Karuturi Global to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Karuturi Global (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives