As global markets navigate a complex landscape marked by trade tensions and economic shifts, Asian markets have shown resilience, with Chinese stocks gaining ground amid expectations of government stimulus. In this environment, identifying undervalued stocks can be a strategic approach for investors seeking opportunities below fair value, especially when considering factors such as market sentiment and macroeconomic developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.99 | CN¥76.64 | 49.1% |

| Taiyo Yuden (TSE:6976) | ¥2411.50 | ¥4741.52 | 49.1% |

| Livero (TSE:9245) | ¥1692.00 | ¥3352.54 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥841.00 | ¥1677.13 | 49.9% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥16.67 | CN¥33.21 | 49.8% |

| Gushengtang Holdings (SEHK:2273) | HK$38.35 | HK$76.50 | 49.9% |

| Fuji (TSE:6134) | ¥2253.50 | ¥4448.27 | 49.3% |

| Everest Medicines (SEHK:1952) | HK$54.55 | HK$107.01 | 49% |

| Brangista (TSE:6176) | ¥597.00 | ¥1180.86 | 49.4% |

| Boditech Med (KOSDAQ:A206640) | ₩15850.00 | ₩31439.92 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

BYD (SEHK:1211)

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of approximately HK$1.17 trillion.

Operations: BYD's revenue is primarily derived from its operations in the automobiles and batteries sectors, serving markets in China, Hong Kong, Macau, Taiwan, and internationally.

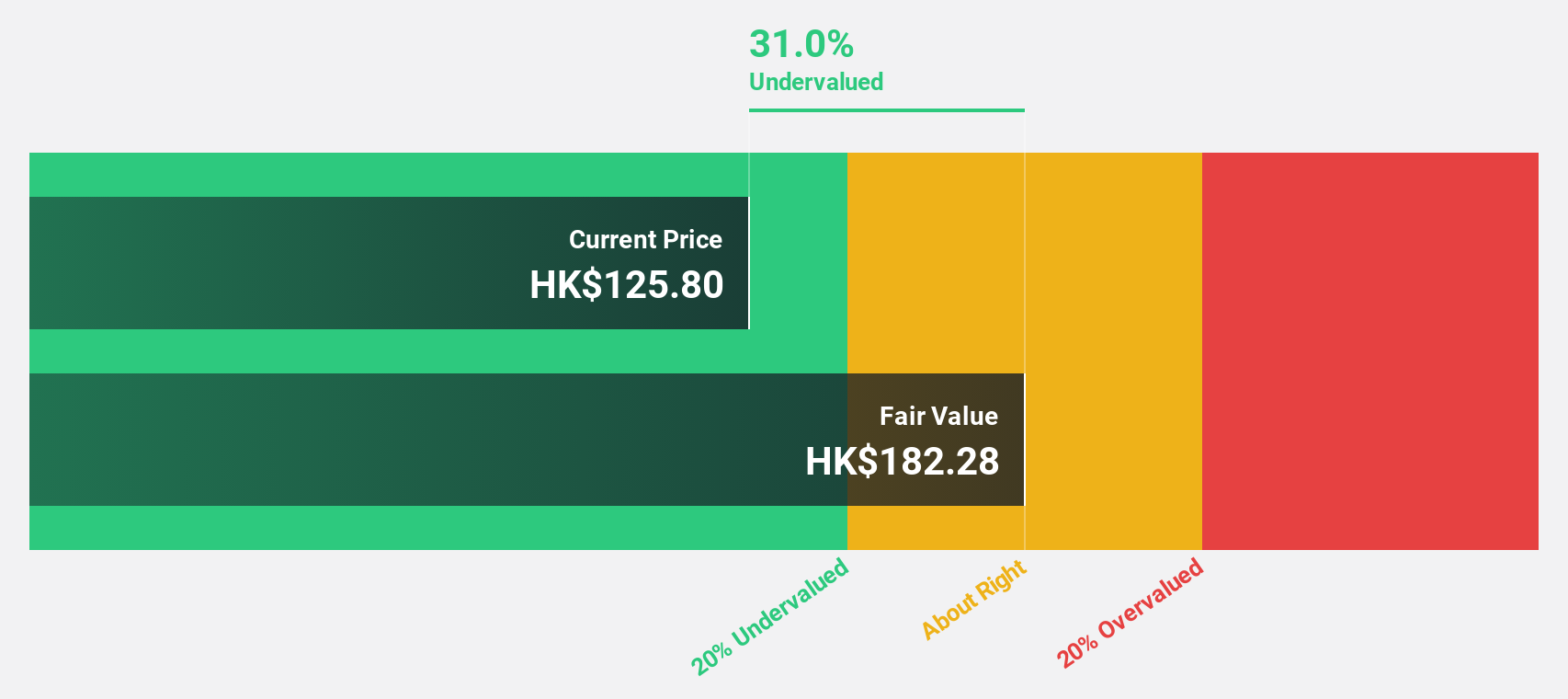

Estimated Discount To Fair Value: 28.2%

BYD is trading at HK$132.2, significantly below its estimated fair value of HK$184.06, indicating potential undervaluation based on cash flows. The company has demonstrated robust earnings growth of 47.2% over the past year and anticipates future revenue growth of 13.2% annually, outpacing the Hong Kong market average. Recent developments include a substantial dividend payout approved at their AGM and expansion plans in Europe, which could further enhance BYD's financial performance and market position in the EV sector.

- Upon reviewing our latest growth report, BYD's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of BYD stock in this financial health report.

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on discovering, licensing, developing, and commercializing therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of HK$17.70 billion.

Operations: The company's revenue segment includes Pharmaceuticals, generating CN¥706.68 million.

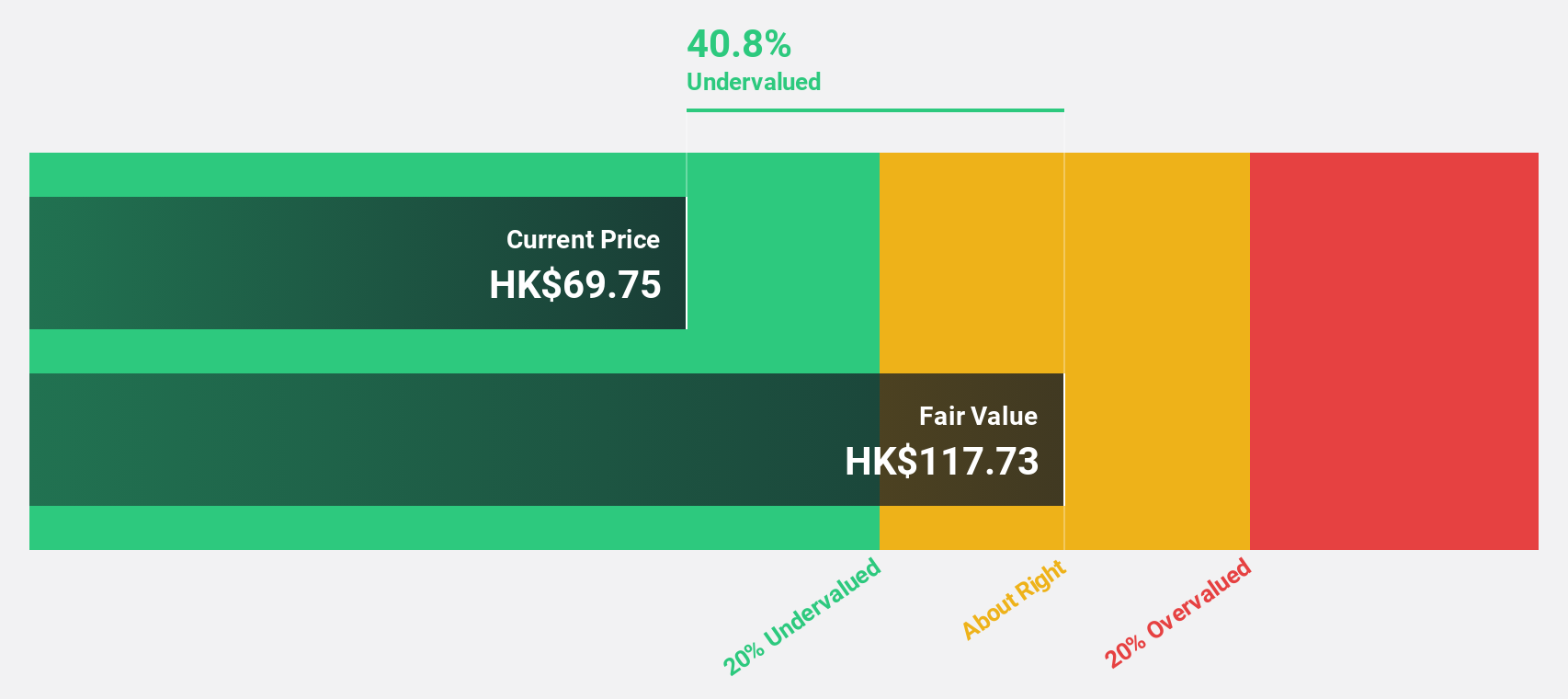

Estimated Discount To Fair Value: 49%

Everest Medicines is trading at HK$54.55, significantly below its estimated fair value of HK$107.01, suggesting potential undervaluation based on cash flows. The company anticipates a robust revenue growth rate of 29.8% annually, surpassing the Hong Kong market average. Recent product approvals for NEFECON in China and positive trial results for EVER001 underscore its strategic advancements in nephrology treatments, though profitability challenges remain with a net loss reported at CNY 1.04 billion last year.

- In light of our recent growth report, it seems possible that Everest Medicines' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Everest Medicines' balance sheet health report.

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People’s Republic of China, with a market cap of HK$51.78 billion.

Operations: The company's revenue segments include Down Apparels generating CN¥20.66 billion, Ladieswear Apparels contributing CN¥735.22 million, Diversified Apparels at CN¥254.12 million, and Original Equipment Manufacturing (OEM) Management bringing in CN¥2.97 billion.

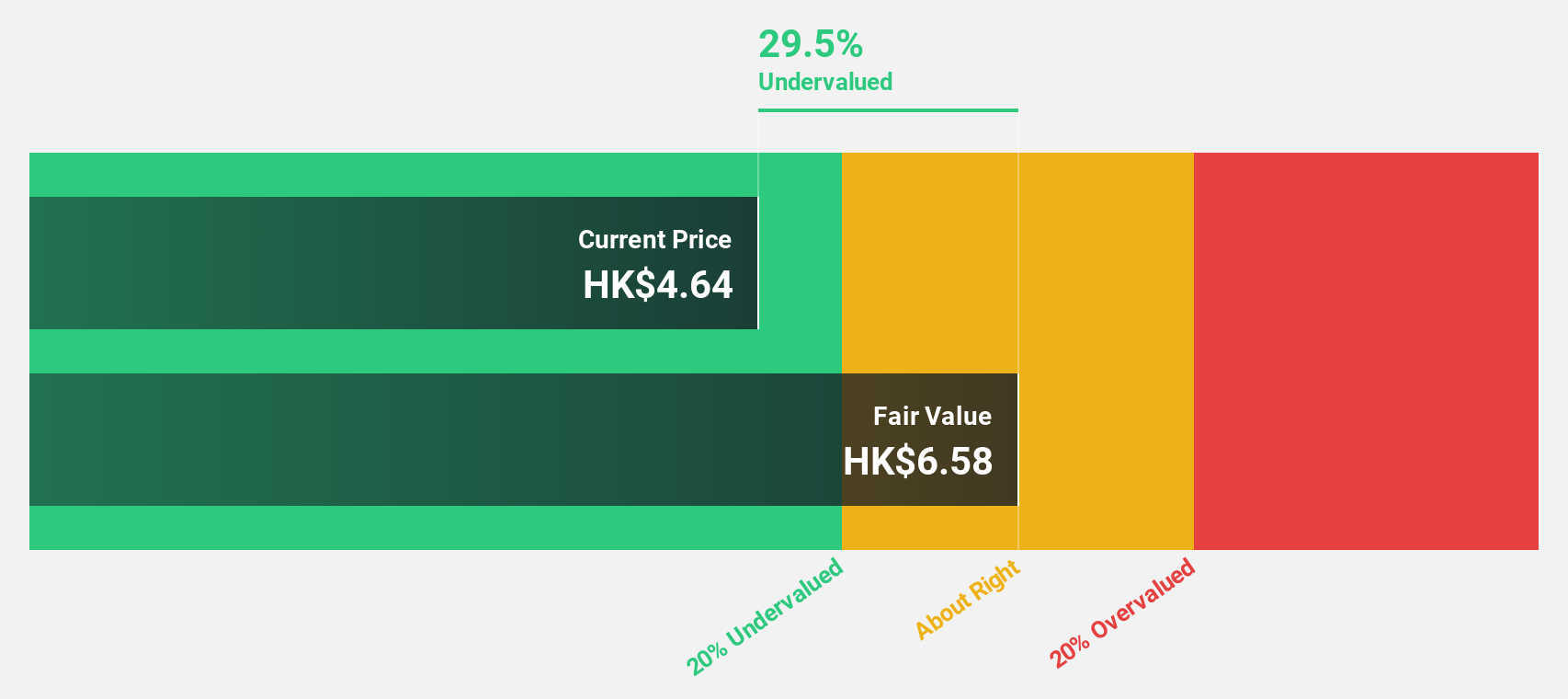

Estimated Discount To Fair Value: 23.2%

Bosideng International Holdings is trading at HK$4.52, below its estimated fair value of HK$5.89, highlighting potential undervaluation based on cash flows. The company's earnings grew by 41.4% last year and are projected to grow 12.92% annually, outpacing the Hong Kong market's average growth rate of 10.4%. Despite an unstable dividend track record, analysts agree the stock price could rise by 23.6%, with revenue growth forecasted at 10.9% per year.

- Our earnings growth report unveils the potential for significant increases in Bosideng International Holdings' future results.

- Delve into the full analysis health report here for a deeper understanding of Bosideng International Holdings.

Seize The Opportunity

- Dive into all 302 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives