- United States

- /

- Airlines

- /

- NYSE:JOBY

Joby Aviation (JOBY) Explores New Defense Aircraft Class with L3Harris Technologies Partnership

Reviewed by Simply Wall St

Joby Aviation (JOBY) and L3Harris Technologies announced a collaboration to develop gas turbine hybrid VTOL aircraft for defense, planned to begin testing in 2025. Over the last quarter, Joby's stock rose 156%, standing out against a market backdrop marked by a 2.7% decline spurred by weak job reports and tariff concerns. The strategic alliance and the planned start of commercial air taxi flights in Dubai, alongside a significant site expansion in Marina, California, highlight Joby's growth and potential that might have partly driven investor interest, counterbalancing broader market trends despite recent economic headwinds.

Over the past year, Joby Aviation's total shareholder return has been an impressive 239.80%, driven largely by its ambitious advancements and strategic initiatives in the urban air mobility sphere. This performance has substantially outpaced the broader US market, which returned 17.7%, and the US Airlines industry, with its 53.7% growth over the same period. Despite the company's ongoing unprofitability and forecast to remain so over the next three years, the significant share price increase reflects investor optimism regarding its recent alignments and its operational expansion.

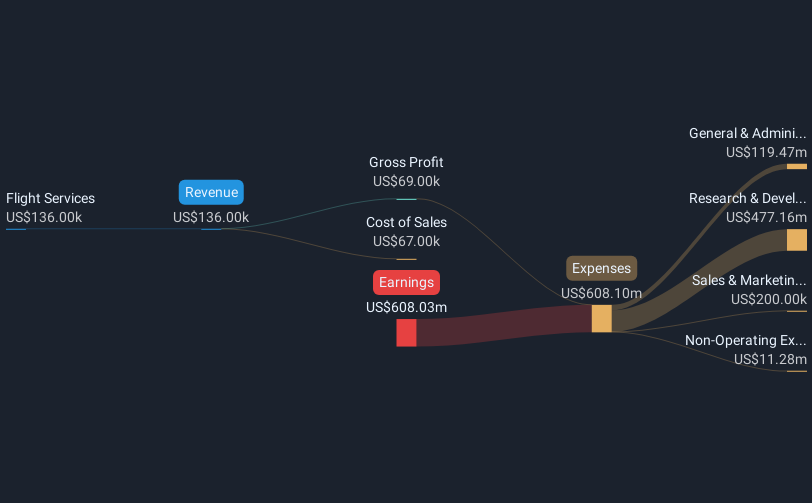

The collaborative efforts with L3Harris Technologies and the expansion of production capabilities in California could potentially boost Joby's revenue, which is projected to grow at a robust rate of 66.3% per year. However, the company remains unprofitable, as indicated by recent earnings reports showing quarter-on-quarter net losses. With the current share price significantly higher than the consensus analyst price target of US$8.75, there appears to be a disconnect between market sentiment and analyst valuations. Investors should cautiously consider these factors when prospecting Joby's potential amidst its ambitious expansion and technological pursuits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOBY

Joby Aviation

A vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives