It Might Be Better To Avoid Willas-Array Electronics (Holdings) Limited's (SGX:BDR) Upcoming 35% Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Willas-Array Electronics (Holdings) Limited (SGX:BDR) is about to go ex-dividend in just 4 days. This means that investors who purchase shares on or after the 7th of August will not receive the dividend, which will be paid on the 26th of August.

Willas-Array Electronics (Holdings)'s next dividend payment will be HK$0.20 per share, on the back of last year when the company paid a total of HK$0.20 to shareholders. Calculating the last year's worth of payments shows that Willas-Array Electronics (Holdings) has a trailing yield of 6.1% on the current share price of SGD0.575. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Willas-Array Electronics (Holdings) has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Willas-Array Electronics (Holdings)

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Willas-Array Electronics (Holdings) paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Willas-Array Electronics (Holdings) paid out more free cash flow than it generated - 117%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. Willas-Array Electronics (Holdings) was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

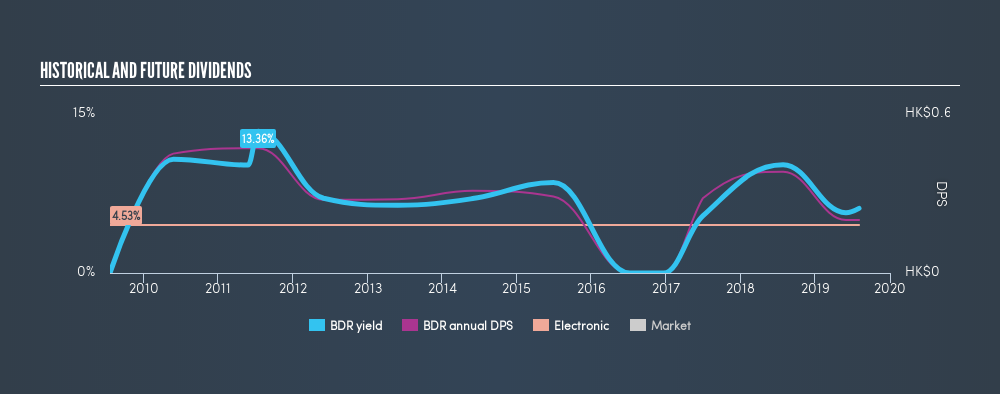

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Willas-Array Electronics (Holdings) has seen its dividend decline 8.6% per annum on average over the past 9 years, which is not great to see.

Remember, you can always get a snapshot of Willas-Array Electronics (Holdings)'s financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Has Willas-Array Electronics (Holdings) got what it takes to maintain its dividend payments? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Second, the dividend was not well covered by cash flow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

Want to learn more about Willas-Array Electronics (Holdings)? Here's a visualisation of its historical rate of revenue and earnings growth.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.