David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Yong Tai Berhad (KLSE:YONGTAI) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Yong Tai Berhad

What Is Yong Tai Berhad's Net Debt?

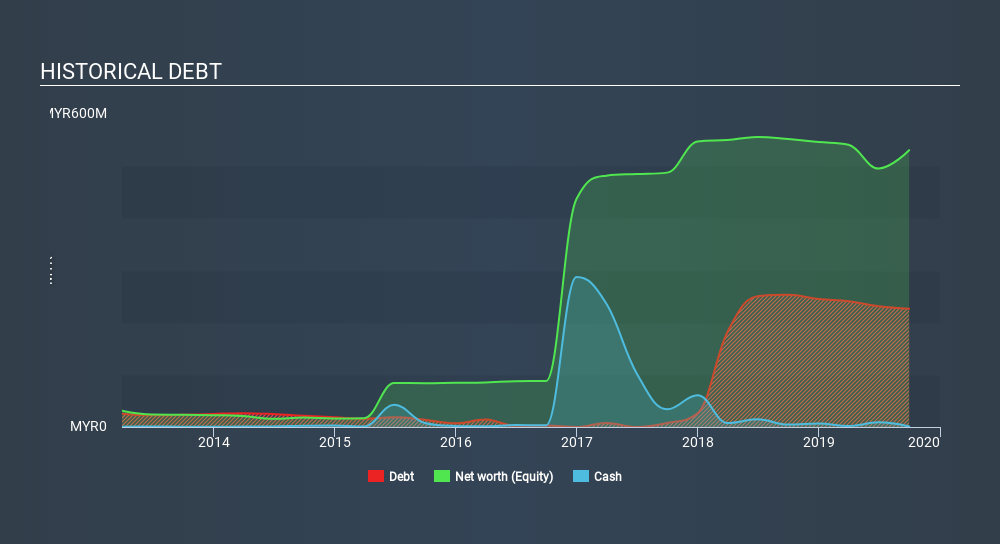

The image below, which you can click on for greater detail, shows that Yong Tai Berhad had debt of RM226.7m at the end of September 2019, a reduction from RM253.4m over a year. And it doesn't have much cash, so its net debt is about the same.

A Look At Yong Tai Berhad's Liabilities

We can see from the most recent balance sheet that Yong Tai Berhad had liabilities of RM363.0m falling due within a year, and liabilities of RM145.2m due beyond that. Offsetting these obligations, it had cash of RM961.0k as well as receivables valued at RM167.3m due within 12 months. So it has liabilities totalling RM339.9m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the RM99.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Yong Tai Berhad would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Yong Tai Berhad can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Yong Tai Berhad had negative earnings before interest and tax, and actually shrunk its revenue by 24%, to RM101m. To be frank that doesn't bode well.

Caveat Emptor

Not only did Yong Tai Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable RM80m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely, given it is low on liquid assets, and burned through RM27m in the last year. So we think this stock is risky, like walking through a dirty dog park with a mask on. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Yong Tai Berhad that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:YONGTAI

Yong Tai Berhad

An investment holding company, engages in the tourism-related property development business in Malaysia.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives