What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Wendt (India) (NSE:WENDT) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Wendt (India) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.027 = ₹38m ÷ (₹1.8b - ₹434m) (Based on the trailing twelve months to June 2020).

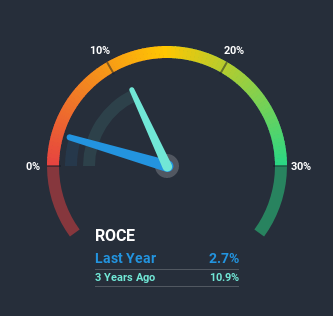

Thus, Wendt (India) has an ROCE of 2.7%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 9.7%.

View our latest analysis for Wendt (India)

Historical performance is a great place to start when researching a stock so above you can see the gauge for Wendt (India)'s ROCE against it's prior returns. If you'd like to look at how Wendt (India) has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Wendt (India) Tell Us?

When we looked at the ROCE trend at Wendt (India), we didn't gain much confidence. To be more specific, ROCE has fallen from 15% over the last five years. Given the business is employing more capital while revenue has slipped, this is a bit concerning. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

Our Take On Wendt (India)'s ROCE

We're a bit apprehensive about Wendt (India) because despite more capital being deployed in the business, returns on that capital and sales have both fallen. Yet despite these concerning fundamentals, the stock has performed strongly with a 89% return over the last five years, so investors appear very optimistic. Regardless, we don't feel to comfortable with the fundamentals so we'd be steering clear of this stock for now.

On a separate note, we've found 5 warning signs for Wendt (India) you'll probably want to know about.

While Wendt (India) may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Wendt (India) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wendt (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:WENDT

Wendt (India)

Manufactures, sells, and services super abrasives, high precision grinding, honing, special purpose machines, and precision components in India and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives