- Canada

- /

- Hospitality

- /

- TSX:TWC

Is TWC Enterprises (TSE:TWC) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, TWC Enterprises Limited (TSE:TWC) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for TWC Enterprises

How Much Debt Does TWC Enterprises Carry?

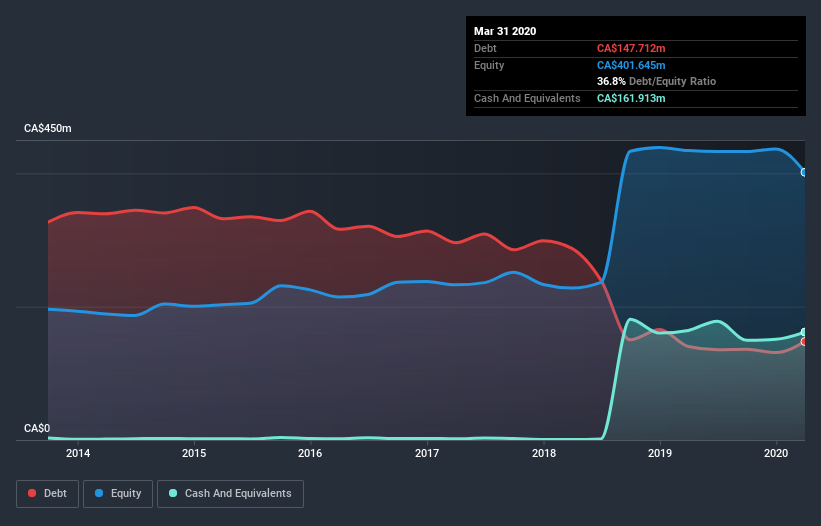

As you can see below, at the end of March 2020, TWC Enterprises had CA$147.7m of debt, up from CA$140.3m a year ago. Click the image for more detail. But on the other hand it also has CA$161.9m in cash, leading to a CA$14.2m net cash position.

A Look At TWC Enterprises's Liabilities

Zooming in on the latest balance sheet data, we can see that TWC Enterprises had liabilities of CA$97.8m due within 12 months and liabilities of CA$188.6m due beyond that. On the other hand, it had cash of CA$161.9m and CA$38.8m worth of receivables due within a year. So its liabilities total CA$85.8m more than the combination of its cash and short-term receivables.

TWC Enterprises has a market capitalization of CA$292.4m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, TWC Enterprises also has more cash than debt, so we're pretty confident it can manage its debt safely.

Unfortunately, TWC Enterprises's EBIT flopped 18% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. When analysing debt levels, the balance sheet is the obvious place to start. But it is TWC Enterprises's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. TWC Enterprises may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, TWC Enterprises produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While TWC Enterprises does have more liabilities than liquid assets, it also has net cash of CA$14.2m. So while TWC Enterprises does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for TWC Enterprises (1 is a bit concerning) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade TWC Enterprises, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TWC Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:TWC

TWC Enterprises

Owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks