The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Skyfii Limited (ASX:SKF) share price is 198% higher than it was three years ago. Most would be happy with that.

View our latest analysis for Skyfii

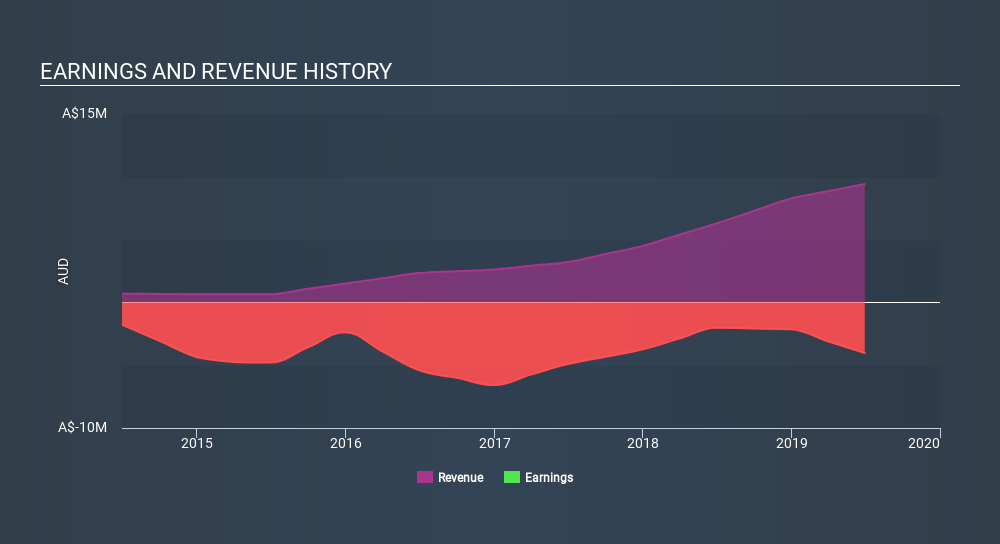

Because Skyfii is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Skyfii's revenue trended up 50% each year over three years. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 44% compound over three years. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Skyfii stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Skyfii shareholders are up 13% for the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 2.2% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Skyfii better, we need to consider many other factors. For example, we've discovered 2 warning signs for Skyfii which any shareholder or potential investor should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:BEO

Beonic

A software technology company, provides data analytics services in Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Mediocre balance sheet low.

Market Insights

Community Narratives