- United States

- /

- Health Care REITs

- /

- NasdaqGS:SBRA

Is Sabra Health Care REIT, Inc. (NASDAQ:SBRA) An Attractive Dividend Stock?

Could Sabra Health Care REIT, Inc. (NASDAQ:SBRA) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

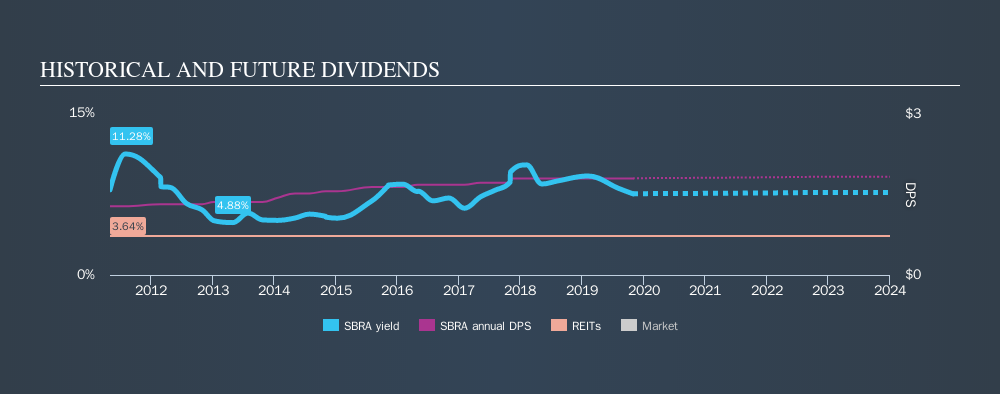

With a eight-year payment history and a 7.6% yield, many investors probably find Sabra Health Care REIT intriguing. It sure looks interesting on these metrics - but there's always more to the story . When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Sabra Health Care REIT paid out 91% of its profit as dividends, over the trailing twelve month period. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 95% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's positive to see that Sabra Health Care REIT's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

It is worth considering that Sabra Health Care REIT is a Real Estate Investment Trust (REIT). REITs have different rules governing their payments, and are often required to pay out a high portion of their earnings to investors.

Is Sabra Health Care REIT's Balance Sheet Risky?

As Sabra Health Care REIT has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). With net debt of 5.85 times its EBITDA, Sabra Health Care REIT could be described as a highly leveraged company. While some companies can handle this level of leverage, we'd be concerned about the dividend sustainability if there was any risk of an earnings downturn.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 1.71 times its interest expense, Sabra Health Care REIT's interest cover is starting to look a bit thin. High debt and weak interest cover are not a great combo, and we would be cautious of relying on this company's dividend while these metrics persist. That said, Sabra Health Care REIT is in the real estate business, which is typically able to sustain much higher levels of debt, relative to other industries.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that Sabra Health Care REIT paid its first dividend at least eight years ago. The dividend has been quite stable over the past eight years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past eight-year period, the first annual payment was US$1.28 in 2011, compared to US$1.80 last year. Dividends per share have grown at approximately 4.4% per year over this time.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Over the past five years, it looks as though Sabra Health Care REIT's EPS have declined at around 29% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Sabra Health Care REIT's earnings per share, which support the dividend, have been anything but stable.

We'd also point out that Sabra Health Care REIT issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Sabra Health Care REIT is paying out an acceptable percentage of its cashflow and profit. Second, earnings per share have been in decline, and the dividend history is shorter than we'd like. With this information in mind, we think Sabra Health Care REIT may not be an ideal dividend stock.

Given that earnings are not growing, the dividend does not look nearly so attractive. See if the 5 analysts are forecasting a turnaround in our free collection of analyst estimates here.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:SBRA

Sabra Health Care REIT

As of March 31, 2025, Sabra’s investment portfolio included 364 real estate properties held for investment (consisting of (i) 224 skilled nursing/transitional care facilities, (ii) 39 senior housing communities (“senior housing - leased”), (iii) 69 senior housing communities operated by third-party property managers pursuant to property management agreements (“senior housing - managed”), (iv) 17 behavioral health facilities and (v) 15 specialty hospitals and other facilities), 15 investments in loans receivable (consisting of three mortgage loans and 12 other loans), four preferred equity investments and two investments in unconsolidated joint ventures.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives