The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Roche Holding AG (VTX:ROG) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Roche Holding

What Is Roche Holding's Net Debt?

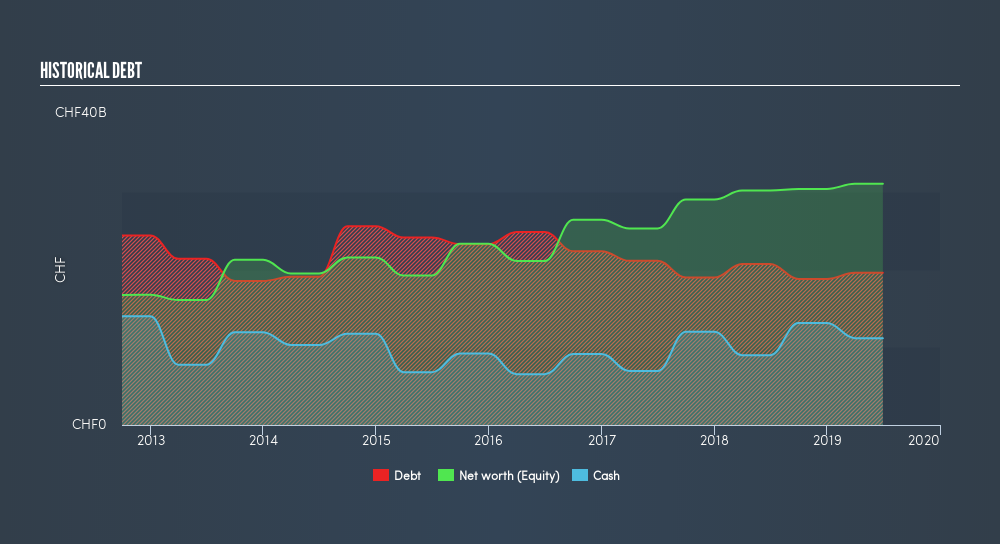

You can click the graphic below for the historical numbers, but it shows that Roche Holding had CHF19.6b of debt in June 2019, down from CHF20.7b, one year before. On the flip side, it has CHF11.2b in cash leading to net debt of about CHF8.40b.

A Look At Roche Holding's Liabilities

According to the last reported balance sheet, Roche Holding had liabilities of CHF23.4b due within 12 months, and liabilities of CHF25.7b due beyond 12 months. Offsetting this, it had CHF11.2b in cash and CHF12.0b in receivables that were due within 12 months. So its liabilities total CHF26.1b more than the combination of its cash and short-term receivables.

Given Roche Holding has a humongous market capitalization of CHF234.0b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Roche Holding's net debt is only 0.36 times its EBITDA. And its EBIT covers its interest expense a whopping 34.0 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Roche Holding has increased its EBIT by 9.0% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Roche Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Roche Holding produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Roche Holding's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Zooming out, Roche Holding seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Roche Holding's dividend history, without delay!

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives