In 2017, Nicklas Westerholm was appointed CEO of PledPharma AB (STO:PLED). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for PledPharma

How Does Nicklas Westerholm's Compensation Compare With Similar Sized Companies?

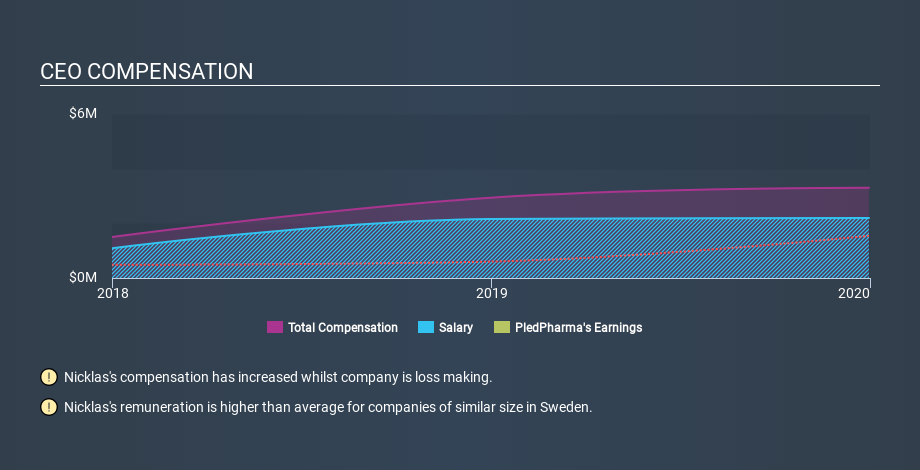

Our data indicates that PledPharma AB is worth kr315m, and total annual CEO compensation was reported as kr3.3m for the year to December 2019. Notably, that's an increase of 12% over the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at kr2.2m. We took a group of companies with market capitalizations below kr1.8b, and calculated the median CEO total compensation to be kr2.0m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where PledPharma stands. On a sector level, around 66% of total compensation represents salary and 34% is other remuneration. PledPharma is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation

It would therefore appear that PledPharma AB pays Nicklas Westerholm more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business. You can see, below, how CEO compensation at PledPharma has changed over time.

Is PledPharma AB Growing?

PledPharma AB has reduced its earnings per share by an average of 1.3% a year, over the last three years (measured with a line of best fit). In the last year, its revenue is down 52%.

In the last three years the company has failed to grow earnings per share. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has PledPharma AB Been A Good Investment?

Given the total loss of 41% over three years, many shareholders in PledPharma AB are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared total CEO remuneration at PledPharma AB with the amount paid at companies with a similar market capitalization. We found that it pays well over the median amount paid in the benchmark group.

Neither earnings per share nor revenue have been growing sufficiently to impress us, over the last three years. Just as bad, share price gains for investors have failed to materialize, over the same period. And we'd be remiss not to note that the CEO remuneration has increased on last year. This analysis suggests to us that the CEO is paid too generously! On another note, we've spotted 5 warning signs for PledPharma that investors should look into moving forward.

If you want to buy a stock that is better than PledPharma, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OM:EGTX

Egetis Therapeutics

A pharmaceutical company, focuses on projects in late-stage development for the treatment of serious diseases with unmet medical needs in the orphan drug segment.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives