Stock Analysis

Is Now The Time To Put Lincoln Pharmaceuticals (NSE:LINCOLN) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Lincoln Pharmaceuticals (NSE:LINCOLN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Lincoln Pharmaceuticals

How Quickly Is Lincoln Pharmaceuticals Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Lincoln Pharmaceuticals has grown EPS by 35% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

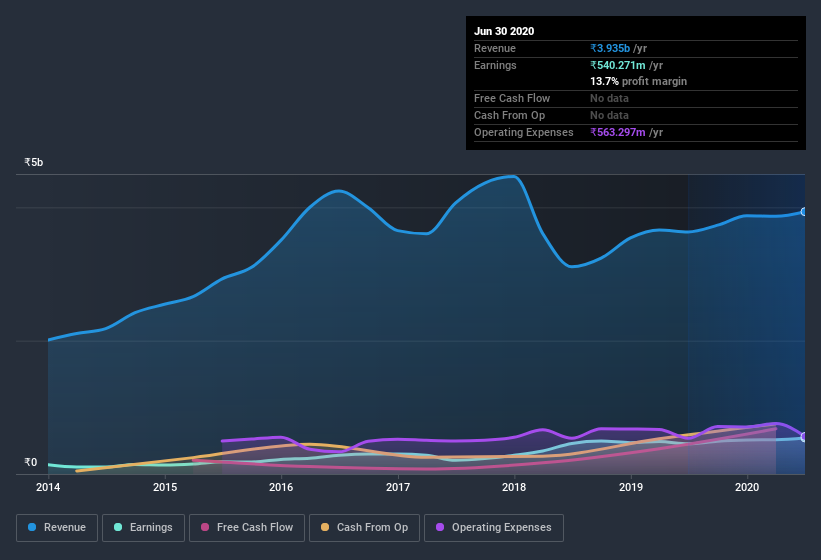

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Lincoln Pharmaceuticals's EBIT margins were flat over the last year, revenue grew by a solid 8.3% to ₹3.9b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Lincoln Pharmaceuticals isn't a huge company, given its market capitalization of ₹4.3b. That makes it extra important to check on its balance sheet strength.

Are Lincoln Pharmaceuticals Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Lincoln Pharmaceuticals shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that MD & Whole Time Director Mahendrabhai Patel bought ₹2.4m worth of shares at an average price of around ₹243.

On top of the insider buying, we can also see that Lincoln Pharmaceuticals insiders own a large chunk of the company. In fact, they own 43% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have ₹1.8b invested in the business, using the current share price. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Mahendrabhai Patel is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations under ₹15b, like Lincoln Pharmaceuticals, the median CEO pay is around ₹4.1m.

The CEO of Lincoln Pharmaceuticals was paid just ₹2.3m in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Lincoln Pharmaceuticals Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Lincoln Pharmaceuticals's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Lincoln Pharmaceuticals you should know about.

As a growth investor I do like to see insider buying. But Lincoln Pharmaceuticals isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Lincoln Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Lincoln Pharmaceuticals is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:LINCOLN

Lincoln Pharmaceuticals

Engages in manufacturing and trading of pharmaceutical products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.