- United States

- /

- Capital Markets

- /

- NasdaqGS:NTRS

Is Northern Trust Corporation's (NASDAQ:NTRS) P/E Ratio Really That Good?

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll look at Northern Trust Corporation's (NASDAQ:NTRS) P/E ratio and reflect on what it tells us about the company's share price. Northern Trust has a price to earnings ratio of 15.73, based on the last twelve months. That is equivalent to an earnings yield of about 6.4%.

See our latest analysis for Northern Trust

How Do I Calculate Northern Trust's Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Northern Trust:

P/E of 15.73 = $106.30 ÷ $6.76 (Based on the trailing twelve months to September 2019.)

Is A High P/E Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Does Northern Trust's P/E Ratio Compare To Its Peers?

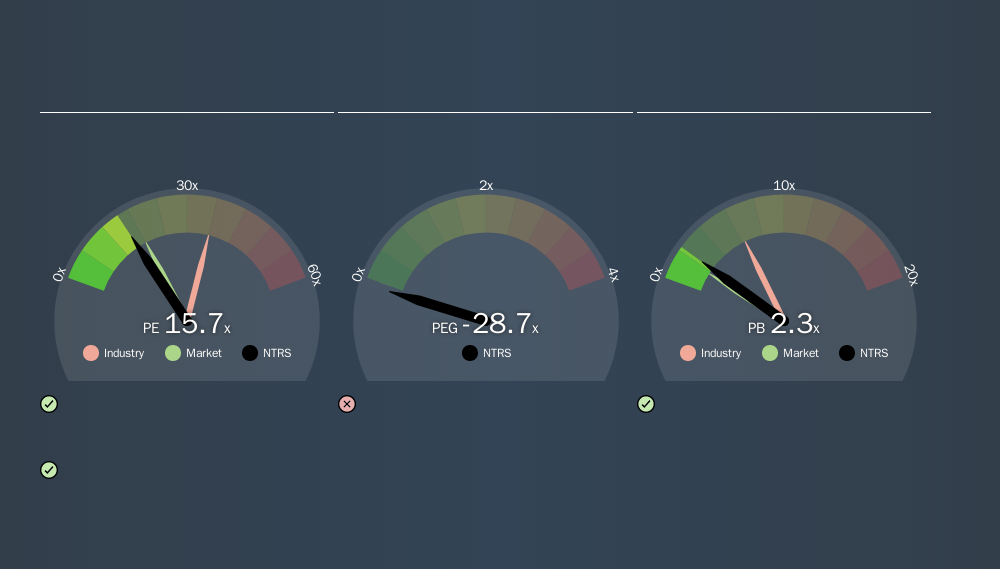

The P/E ratio essentially measures market expectations of a company. The image below shows that Northern Trust has a lower P/E than the average (34.2) P/E for companies in the capital markets industry.

This suggests that market participants think Northern Trust will underperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Northern Trust's earnings per share grew by -5.7% in the last twelve months. And it has bolstered its earnings per share by 17% per year over the last five years. Shareholders have some reason to be optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

How Does Northern Trust's Debt Impact Its P/E Ratio?

Net debt totals just 8.8% of Northern Trust's market cap. So it doesn't have as many options as it would with net cash, but its debt would not have much of an impact on its P/E ratio.

The Verdict On Northern Trust's P/E Ratio

Northern Trust has a P/E of 15.7. That's below the average in the US market, which is 18.0. The company does have a little debt, and EPS is moving in the right direction. If you believe growth will continue - or even increase - then the low P/E may signify opportunity.

Investors should be looking to buy stocks that the market is wrong about. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

You might be able to find a better buy than Northern Trust. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:NTRS

Northern Trust

A financial holding company, provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion