The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Mercor SA (WSE:MCR) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Mercor

What Is Mercor's Net Debt?

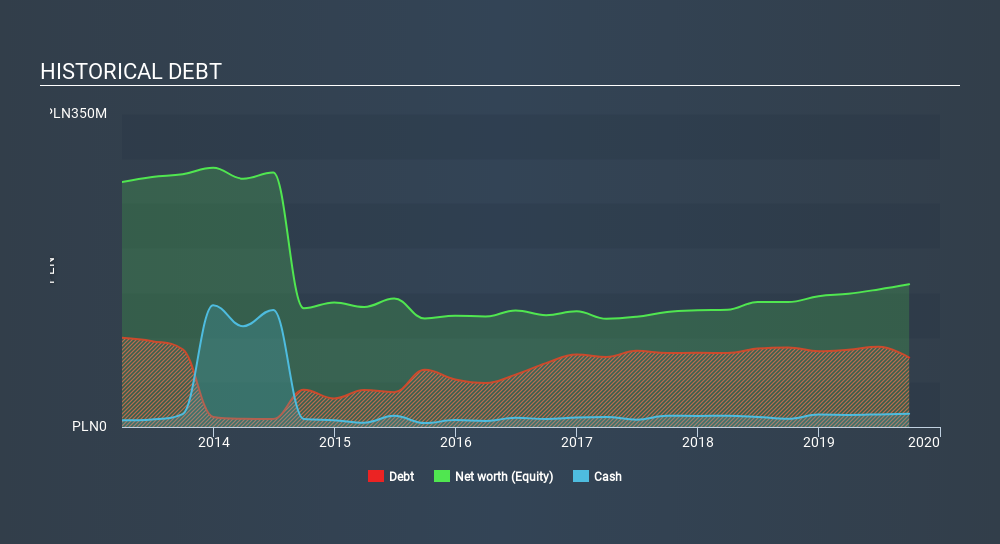

As you can see below, Mercor had zł77.6m of debt at September 2019, down from zł89.0m a year prior. However, it also had zł14.9m in cash, and so its net debt is zł62.7m.

A Look At Mercor's Liabilities

Zooming in on the latest balance sheet data, we can see that Mercor had liabilities of zł103.9m due within 12 months and liabilities of zł97.5m due beyond that. Offsetting these obligations, it had cash of zł14.9m as well as receivables valued at zł104.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł81.9m.

This deficit isn't so bad because Mercor is worth zł150.0m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Mercor's net debt of 1.7 times EBITDA suggests graceful use of debt. And the fact that its trailing twelve months of EBIT was 7.9 times its interest expenses harmonizes with that theme. On top of that, Mercor grew its EBIT by 60% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Mercor's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Mercor created free cash flow amounting to 7.1% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On our analysis Mercor's EBIT growth rate should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. Looking at all this data makes us feel a little cautious about Mercor's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Mercor has 2 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:MCR

Mercor

Designs, manufactures, sells, installs, and services passive fire protection systems.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives