- United States

- /

- Trade Distributors

- /

- NasdaqGS:MGRC

Is McGrath RentCorp (NASDAQ:MGRC) A Future Multi-bagger?

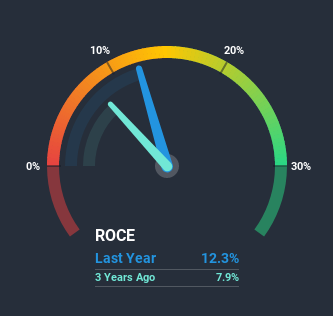

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in McGrath RentCorp's (NASDAQ:MGRC) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on McGrath RentCorp is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = US$147m ÷ (US$1.3b - US$117m) (Based on the trailing twelve months to June 2020).

Therefore, McGrath RentCorp has an ROCE of 12%. In absolute terms, that's a satisfactory return, but compared to the Commercial Services industry average of 9.7% it's much better.

See our latest analysis for McGrath RentCorp

In the above chart we have measured McGrath RentCorp's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

So How Is McGrath RentCorp's ROCE Trending?

McGrath RentCorp is showing promise given that its ROCE is trending up and to the right. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 58% in that same time. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

What We Can Learn From McGrath RentCorp's ROCE

In summary, we're delighted to see that McGrath RentCorp has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Since the stock has returned a staggering 201% to shareholders over the last five years, it looks like investors are recognizing these changes. Therefore, we think it would be worth your time to check if these trends are going to continue.

If you want to continue researching McGrath RentCorp, you might be interested to know about the 3 warning signs that our analysis has discovered.

While McGrath RentCorp may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade McGrath RentCorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:MGRC

McGrath RentCorp

Operates as a business-to-business rental company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The Infrastructure AI Cannot Be Built Without

ASML: Durable Advantage, Limited Margin for Error

A formidable player in AI and enterprise computing.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks