- United States

- /

- Consumer Durables

- /

- NYSE:LZB

Is La-Z-Boy Incorporated's (NYSE:LZB) Growth Strong Enough To Justify Its August Share Price?

La-Z-Boy Incorporated (NYSE:LZB) is considered a high-growth stock, but its last closing price of $32.19 left some investors wondering if this high future earnings potential can be rationalized by its current price tag. Let’s look into this by assessing LZB's expected growth over the next few years.

Check out our latest analysis for La-Z-Boy

Has the LZB train slowed down?

Investors in La-Z-Boy have been patiently waiting for the uptick in earnings. If you believe the analysts covering the stock then the following year will be very interesting. The consensus forecast from 4 analysts is bullish with earnings forecasted to rise significantly from today's level of $1.46 to $2.759 over the next three years. This indicates an estimated earnings growth rate of 13% per year, on average, which signals a market-beating outlook in the upcoming years.

Can LZB's share price be justified by its earnings growth?

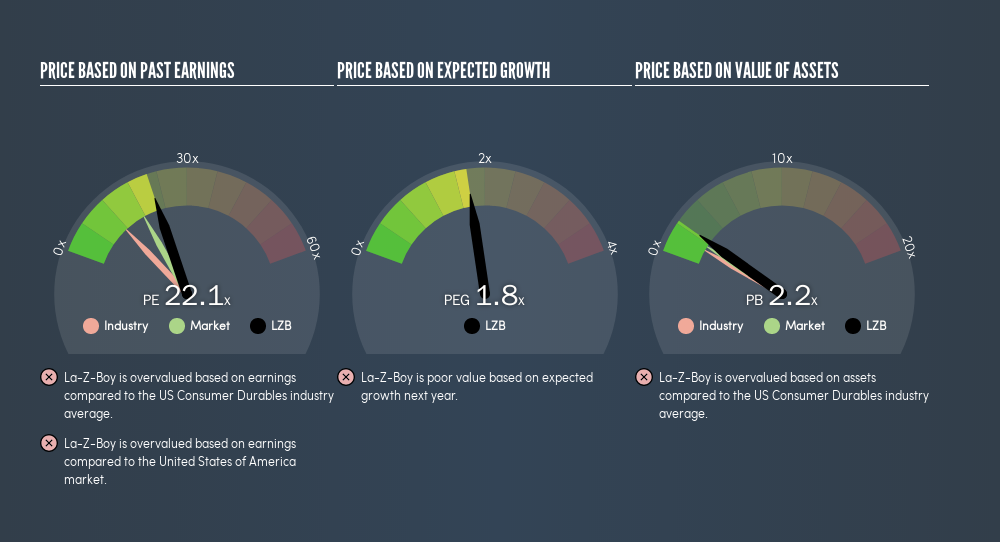

As the legendary value investor Ben Graham once said, “Price is what you pay, value is what you get.” La-Z-Boy is trading at price-to-earnings (PE) ratio of 22.05x, which tells us the stock is overvalued based on current earnings compared to the Consumer Durables industry average of 11.4x , and overvalued compared to the US market average ratio of 17.55x .

We understand LZB seems to be overvalued based on its current earnings, compared to its industry peers. However, seeing as La-Z-Boy is perceived as a high-growth stock, we must also account for its earnings growth, which is captured in the PEG ratio. A PE ratio of 22.05x and expected year-on-year earnings growth of 13% give La-Z-Boy a higher PEG ratio of 1.76x. This tells us that when we include its growth in our analysis La-Z-Boy's stock can be considered a bit overvalued , based on fundamental analysis.

What this means for you:

LZB's current overvaluation could signal a potential selling opportunity to reduce your exposure to the stock, or it you're a potential investor, now may not be the right time to buy. However, basing your investment decision off one metric alone is certainly not sufficient. There are many things I have not taken into account in this article and the PEG ratio is very one-dimensional. If you have not done so already, I urge you to complete your research by taking a look at the following:

- Financial Health: Are LZB’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Past Track Record: Has LZB been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of LZB's historicals for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:LZB

La-Z-Boy

Manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion