- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

Is Kandi Technologies Group, Inc. (NASDAQ:KNDI) Overpaying Its CEO?

In 2007, Xiaoming Hu was appointed CEO of Kandi Technologies Group, Inc. (NASDAQ:KNDI). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for Kandi Technologies Group

How Does Xiaoming Hu's Compensation Compare With Similar Sized Companies?

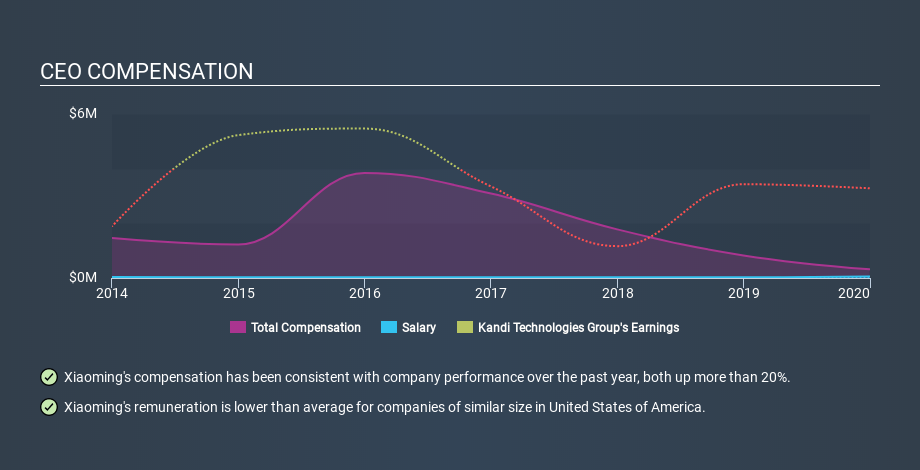

Our data indicates that Kandi Technologies Group, Inc. is worth US$182m, and total annual CEO compensation was reported as US$316k for the year to December 2019. That's less than last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$52k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from US$100m to US$400m, we found the median CEO total compensation was US$1.3m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Kandi Technologies Group stands. On an industry level, roughly 20% of total compensation represents salary and 80% is other remuneration. Kandi Technologies Group does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. Though positive, it's important we delve into the performance of the actual business. You can see, below, how CEO compensation at Kandi Technologies Group has changed over time.

Is Kandi Technologies Group, Inc. Growing?

Kandi Technologies Group, Inc. has seen earnings per share (EPS) move positively by an average of 49% a year, over the last three years (using a line of best fit). It achieved revenue growth of 21% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Kandi Technologies Group, Inc. Been A Good Investment?

Since shareholders would have lost about 17% over three years, some Kandi Technologies Group, Inc. shareholders would surely be feeling negative emotions. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

It looks like Kandi Technologies Group, Inc. pays its CEO less than similar sized companies.

Many would consider this to indicate that the pay is modest since the business is growing. Despite some positives, it is likely that shareholders wanted better returns, given the performance over the last three years. We're not critical of the remuneration Xiaoming Hu receives, but it would be good to see improved returns to shareholders before the remuneration grows too much. In this case we may want to look deeper into the company. There are some real positives and we could see improved returns in the longer term. CEO compensation is an important area to keep your eyes on, but we've also identified 3 warning signs for Kandi Technologies Group (2 shouldn't be ignored!) that you should be aware of before investing here.

Important note: Kandi Technologies Group may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:KNDI

Kandi Technologies Group

Produces and sells electric off-road vehicles and associated parts in the People’s Republic of China, the United States, and internationally.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Why did Novo Nordisk flop?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks