Greg Yull became the CEO of Intertape Polymer Group Inc. (TSE:ITP) in 2010. First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Intertape Polymer Group

How Does Greg Yull's Compensation Compare With Similar Sized Companies?

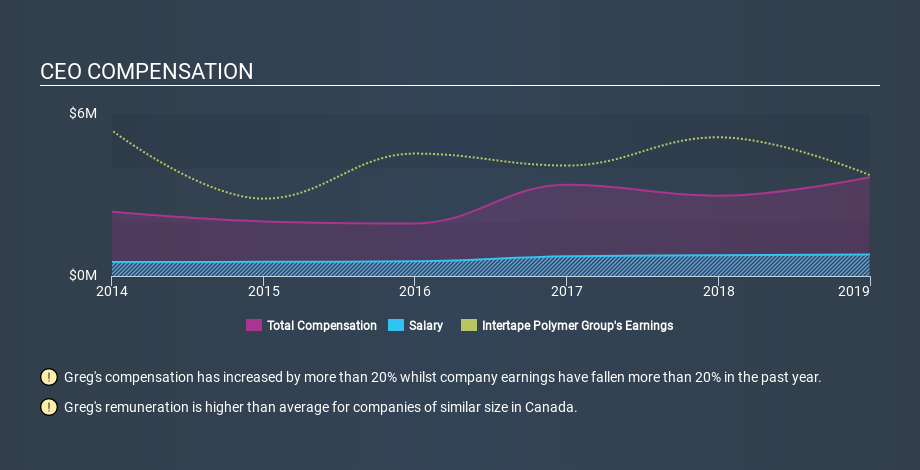

Our data indicates that Intertape Polymer Group Inc. is worth CA$973m, and total annual CEO compensation was reported as US$3.7m for the year to December 2018. While we always look at total compensation first, we note that the salary component is less, at US$800k. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. We examined companies with market caps from US$400m to US$1.6b, and discovered that the median CEO total compensation of that group was US$1.6m.

Thus we can conclude that Greg Yull receives more in total compensation than the median of a group of companies in the same market, and of similar size to Intertape Polymer Group Inc.. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see, below, how CEO compensation at Intertape Polymer Group has changed over time.

Is Intertape Polymer Group Inc. Growing?

On average over the last three years, Intertape Polymer Group Inc. has shrunk earnings per share by 7.1% each year (measured with a line of best fit). In the last year, its revenue is up 15%.

Sadly for shareholders, earnings per share are actually down, over three years. While the revenue growth is good to see, it is outweighed by the fact that earnings per share are down, over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has Intertape Polymer Group Inc. Been A Good Investment?

Given the total loss of 23% over three years, many shareholders in Intertape Polymer Group Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We compared total CEO remuneration at Intertape Polymer Group Inc. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us. Just as bad, share price gains for investors have failed to materialize, over the same period. In our opinion the CEO might be paid too generously! Whatever your view on compensation, you might want to check if insiders are buying or selling Intertape Polymer Group shares (free trial).

Important note: Intertape Polymer Group may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:ITP

Intertape Polymer Group

Intertape Polymer Group Inc. provides packaging and protective solutions for the industrial markets in North America, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.