Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that IAMGOLD Corporation (TSE:IMG) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for IAMGOLD

What Is IAMGOLD's Debt?

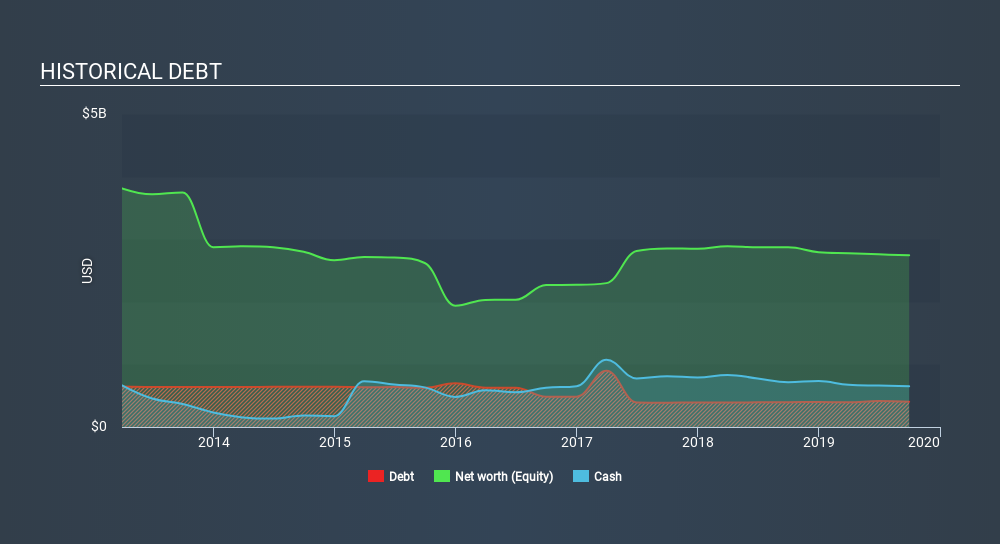

As you can see below, IAMGOLD had US$404.7m of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, its balance sheet shows it holds US$650.7m in cash, so it actually has US$246.0m net cash.

How Strong Is IAMGOLD's Balance Sheet?

The latest balance sheet data shows that IAMGOLD had liabilities of US$243.7m due within a year, and liabilities of US$956.2m falling due after that. On the other hand, it had cash of US$650.7m and US$66.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$483.0m.

IAMGOLD has a market capitalization of US$1.41b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, IAMGOLD also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if IAMGOLD can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year IAMGOLD had negative earnings before interest and tax, and actually shrunk its revenue by 7.2%, to US$1.0b. We would much prefer see growth.

So How Risky Is IAMGOLD?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year IAMGOLD had negative earnings before interest and tax (EBIT), truth be told. And over the same period it saw negative free cash outflow of US$195m and booked a US$94m accounting loss. But the saving grace is the US$246.0m on the balance sheet. That means it could keep spending at its current rate for more than two years. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. For riskier companies like IAMGOLD I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives