- United States

- /

- Insurance

- /

- NYSE:EG

Is Everest Re Group, Ltd. (NYSE:RE) Potentially Underrated?

Everest Re Group, Ltd. (NYSE:RE) is a company with exceptional fundamental characteristics. Upon building up an investment case for a stock, we should look at various aspects. In the case of RE, it is a dependable dividend-paying company that has been able to sustain great financial health over the past. Below is a brief commentary on these key aspects. For those interested in digging a bit deeper into my commentary, take a look at the report on Everest Re Group here.

Excellent balance sheet established dividend payer

RE is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This implies that RE manages its cash and cost levels well, which is a key determinant of the company’s health. RE appears to have made good use of debt, producing operating cash levels of 2.1x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

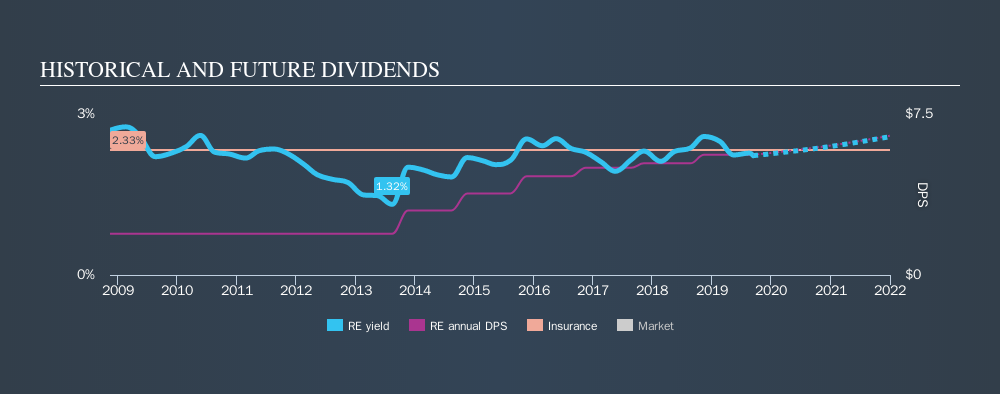

For those seeking income streams from their portfolio, RE is a robust dividend payer as well. Over the past decade, the company has consistently increased its dividend payout, reaching a yield of 2.2%.

Next Steps:

For Everest Re Group, I've compiled three key aspects you should further research:

- Future Outlook: What are well-informed industry analysts predicting for RE’s future growth? Take a look at our free research report of analyst consensus for RE’s outlook.

- Historical Performance: What has RE's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of RE? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:EG

Everest Group

Together with subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks