Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Dyna-Mac Holdings Ltd. (SGX:NO4) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Dyna-Mac Holdings

How Much Debt Does Dyna-Mac Holdings Carry?

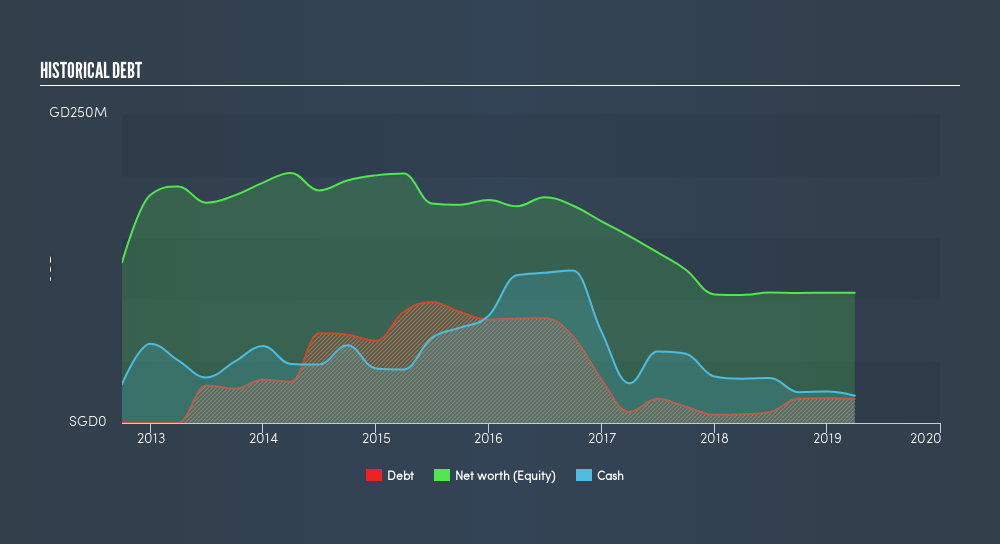

The image below, which you can click on for greater detail, shows that at March 2019 Dyna-Mac Holdings had debt of S$19.3m, up from S$7.55m in one year. However, its balance sheet shows it holds S$22.1m in cash, so it actually has S$2.76m net cash.

How Strong Is Dyna-Mac Holdings's Balance Sheet?

The latest balance sheet data shows that Dyna-Mac Holdings had liabilities of S$44.5m due within a year, and liabilities of S$30.4m falling due after that. Offsetting these obligations, it had cash of S$22.1m as well as receivables valued at S$45.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$7.20m.

Given Dyna-Mac Holdings has a market capitalization of S$111.5m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Dyna-Mac Holdings boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Dyna-Mac Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Dyna-Mac Holdings managed to grow its revenue by 95%, to S$102m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Dyna-Mac Holdings?

While Dyna-Mac Holdings lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of S$1.2m. So when you consider it has net cash, along with the statutory profit, the stock probably isn't as risky as it might seem, at least in the short term. The good news for Dyna-Mac Holdings shareholders is that its revenue growth is strong, making it easier to raise capital if need be. But we still think it's somewhat risky. For riskier companies like Dyna-Mac Holdings I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:NO4

Dyna-Mac Holdings

An investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives