Is China Sanjiang Fine Chemicals (HKG:2198) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that China Sanjiang Fine Chemicals Company Limited (HKG:2198) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for China Sanjiang Fine Chemicals

What Is China Sanjiang Fine Chemicals's Debt?

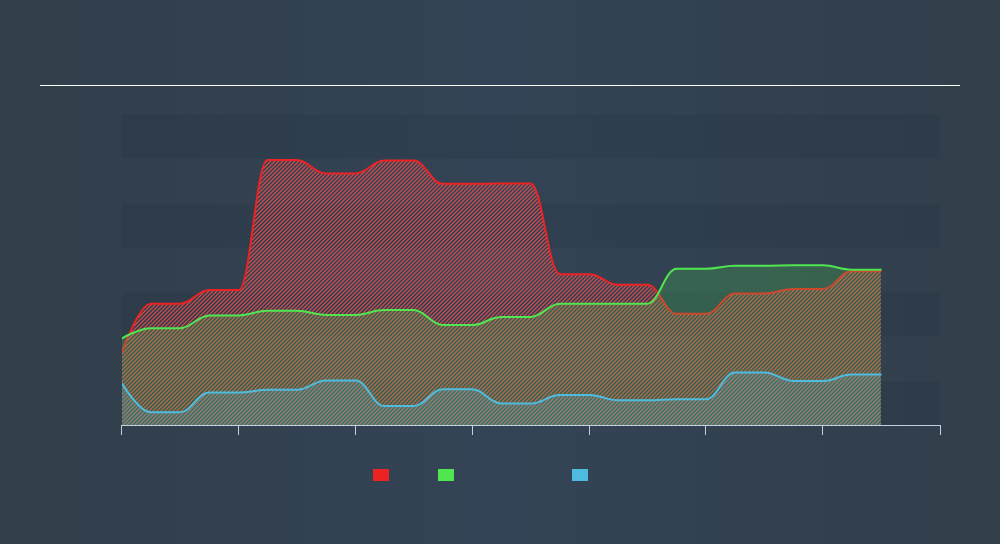

The image below, which you can click on for greater detail, shows that at June 2019 China Sanjiang Fine Chemicals had debt of CN¥3.46b, up from CN¥2.96b in one year. However, it does have CN¥1.14b in cash offsetting this, leading to net debt of about CN¥2.32b.

How Strong Is China Sanjiang Fine Chemicals's Balance Sheet?

We can see from the most recent balance sheet that China Sanjiang Fine Chemicals had liabilities of CN¥6.31b falling due within a year, and liabilities of CN¥9.65m due beyond that. On the other hand, it had cash of CN¥1.14b and CN¥667.0m worth of receivables due within a year. So its liabilities total CN¥4.52b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CN¥1.65b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, China Sanjiang Fine Chemicals would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is China Sanjiang Fine Chemicals's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year China Sanjiang Fine Chemicals had negative earnings before interest and tax, and actually shrunk its revenue by 4.3%, to CN¥9.0b. We would much prefer see growth.

Caveat Emptor

Importantly, China Sanjiang Fine Chemicals had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost CN¥4.9m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely, given it is low on liquid assets, and burned through CN¥94m in the last year. So we think this stock is risky, like walking through a dirty dog park with a mask on. For riskier companies like China Sanjiang Fine Chemicals I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:2198

China Sanjiang Fine Chemicals

An investment holding company, manufactures and supplies ethylene oxide and glycol, propylene, polypropylene, methyl tert-butyl ether (MTBE), surfactants, and ethanolamine in Mainland China, Japan, and Singapore, and internationally.

Proven track record and slightly overvalued.

Market Insights

Community Narratives