- United States

- /

- Life Sciences

- /

- NYSE:CRL

Is Charles River Laboratories International (NYSE:CRL) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Charles River Laboratories International, Inc. (NYSE:CRL) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Charles River Laboratories International

How Much Debt Does Charles River Laboratories International Carry?

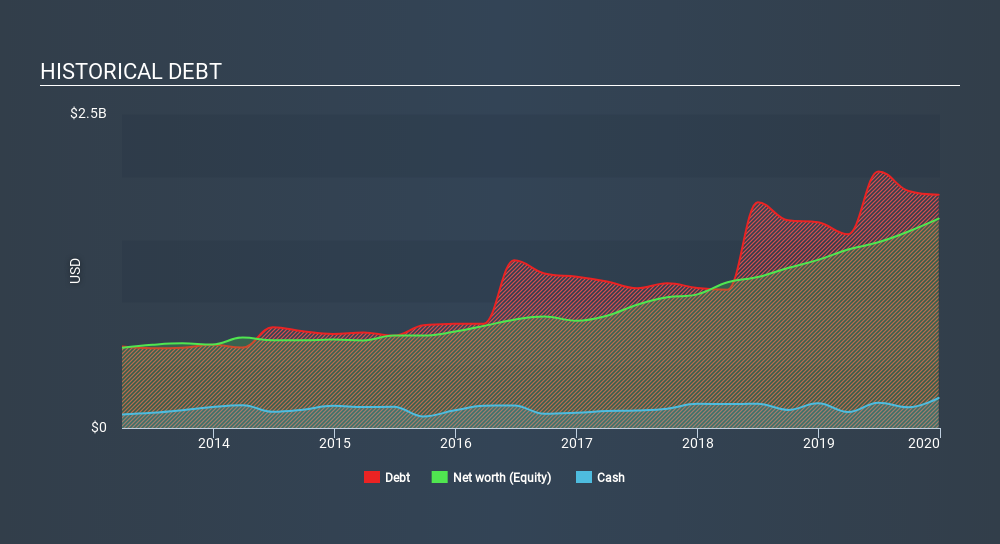

You can click the graphic below for the historical numbers, but it shows that as of December 2019 Charles River Laboratories International had US$1.86b of debt, an increase on US$1.64b, over one year. On the flip side, it has US$239.0m in cash leading to net debt of about US$1.62b.

A Look At Charles River Laboratories International's Liabilities

According to the last reported balance sheet, Charles River Laboratories International had liabilities of US$710.2m due within 12 months, and liabilities of US$2.32b due beyond 12 months. On the other hand, it had cash of US$239.0m and US$514.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.27b.

This deficit isn't so bad because Charles River Laboratories International is worth US$6.37b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Charles River Laboratories International has a debt to EBITDA ratio of 2.9 and its EBIT covered its interest expense 6.2 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. We saw Charles River Laboratories International grow its EBIT by 7.2% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Charles River Laboratories International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Charles River Laboratories International recorded free cash flow worth a fulsome 85% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Happily, Charles River Laboratories International's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. All these things considered, it appears that Charles River Laboratories International can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Charles River Laboratories International that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives