Lars van der Haegen became the CEO of BELIMO Holding AG (VTX:BEAN) in 2015. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for BELIMO Holding

How Does Lars van der Haegen's Compensation Compare With Similar Sized Companies?

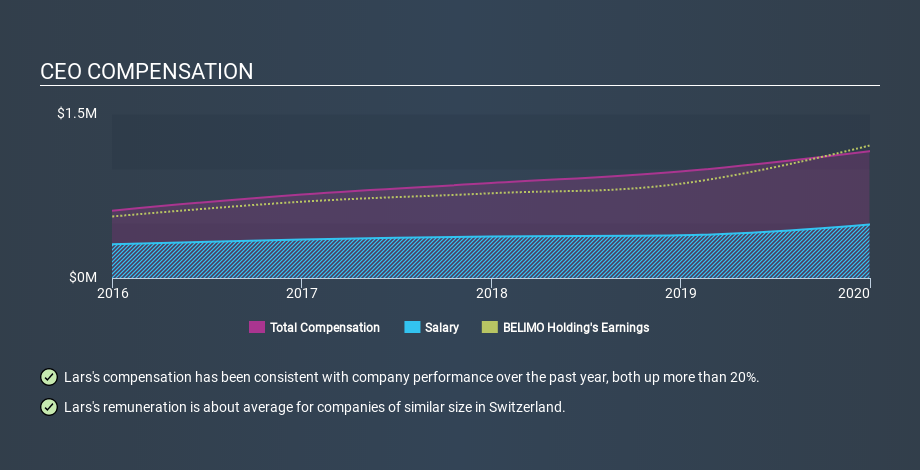

Our data indicates that BELIMO Holding AG is worth CHF4.4b, and total annual CEO compensation was reported as CHF1.2m for the year to December 2019. We note that's an increase of 19% above last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at CHF490k. We looked at a group of companies with market capitalizations from CHF1.9b to CHF6.2b, and the median CEO total compensation was CHF1.6m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where BELIMO Holding stands. On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. BELIMO Holding is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation

So Lars van der Haegen receives a similar amount to the median CEO pay, amongst the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context. You can see a visual representation of the CEO compensation at BELIMO Holding, below.

Is BELIMO Holding AG Growing?

On average over the last three years, BELIMO Holding AG has seen earnings per share (EPS) move in a favourable direction by 17% each year (using a line of best fit). It achieved revenue growth of 7.8% over the last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has BELIMO Holding AG Been A Good Investment?

I think that the total shareholder return of 96%, over three years, would leave most BELIMO Holding AG shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Remuneration for Lars van der Haegen is close enough to the median pay for a CEO of a similar sized company .

Shareholders would surely be happy to see that shareholder returns have been great, and the earnings per share are up. Indeed, many might consider the pay rather modest, given the solid company performance! Moving away from CEO compensation for the moment, we've identified 1 warning sign for BELIMO Holding that you should be aware of before investing.

Important note: BELIMO Holding may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SWX:BEAN

BELIMO Holding

Engages in the development, production, and sale of damper actuators, control valves, sensors, and meters for heating, ventilation, and air conditioning systems (HVAC) in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives