Is Befimmo SA's (EBR:BEFB) CEO Paid Enough Relative To Peers?

Benoît De Blieck became the CEO of Befimmo SA (EBR:BEFB) in 1999. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Befimmo

How Does Benoît De Blieck's Compensation Compare With Similar Sized Companies?

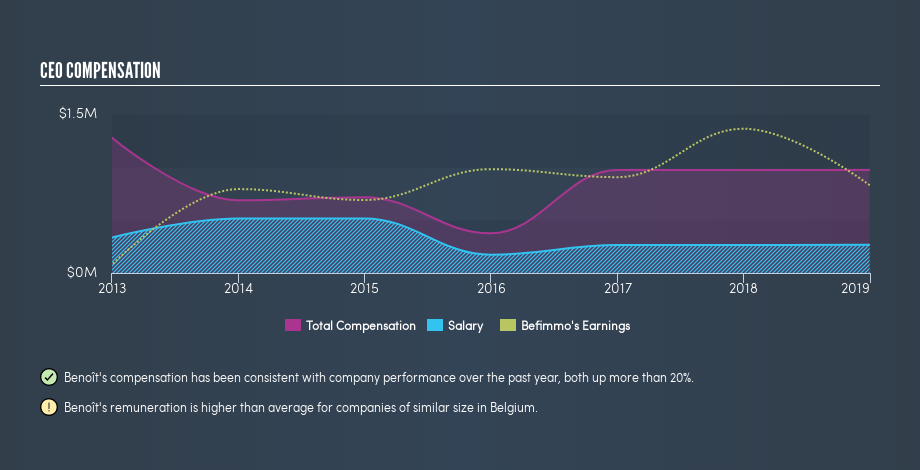

At the time of writing our data says that Befimmo SA has a market cap of €1.3b, and is paying total annual CEO compensation of €973k. (This number is for the twelve months until December 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at €265k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of €898m to €2.9b. The median total CEO compensation was €696k.

Thus we can conclude that Benoît De Blieck receives more in total compensation than the median of a group of companies in the same market, and of similar size to Befimmo SA. However, this doesn't necessarily mean the pay is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

You can see a visual representation of the CEO compensation at Befimmo, below.

Is Befimmo SA Growing?

Befimmo SA has increased its earnings per share (EPS) by an average of 7.0% a year, over the last three years (using a line of best fit). It saw its revenue drop -2.0% over the last year.

I would argue that the lack of revenue growth in the last year is less than ideal, but the improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching.

Has Befimmo SA Been A Good Investment?

With a three year total loss of 1.8%, Befimmo SA would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared the total CEO remuneration paid by Befimmo SA, and compared it to remuneration at a group of similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

Over the last three years, shareholder returns have been downright disappointing, and the underlying business has failed to impress us. Considering this, we have the opinion that the CEO pay is more on the generous side, than the modest side. Whatever your view on compensation, you might want to check if insiders are buying or selling Befimmo shares (free trial).

Important note: Befimmo may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTBR:BEFB

Befimmo

Befimmo, a Regulated Real-Estate Investment Trust (BE-REIT), listed on Euronext Brussels, is a real-estate operator specialising in office buildings, meeting centres and coworking spaces.

Questionable track record with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion