- Italy

- /

- Diversified Financial

- /

- BIT:BFF

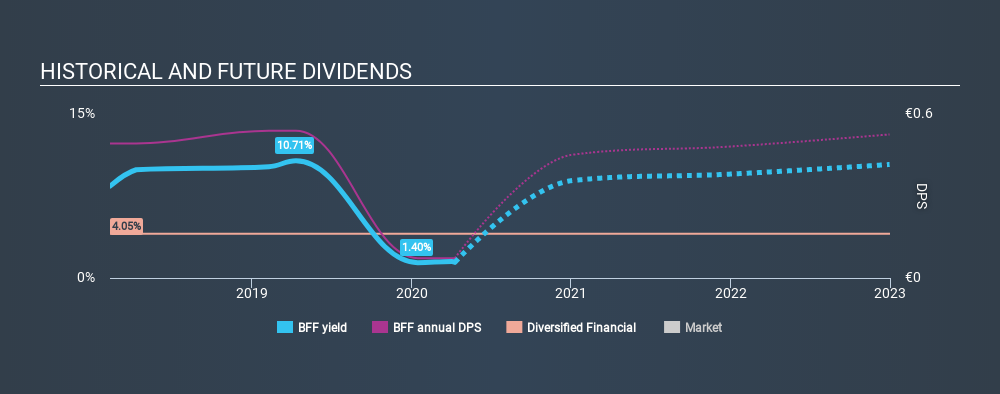

Is Banca Farmafactoring S.p.A.'s (BIT:BFF) 1.4% Dividend Sustainable?

Dividend paying stocks like Banca Farmafactoring S.p.A. (BIT:BFF) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

With only a two-year payment history, and a 1.4% yield, investors probably think Banca Farmafactoring is not much of a dividend stock. Many of the best dividend stocks typically start out paying a low yield, so we wouldn't automatically cut it from our list of prospects. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Banca Farmafactoring paid out 13% of its profit as dividends. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

Remember, you can always get a snapshot of Banca Farmafactoring's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. This company's dividend has been unstable, and with a relatively short history, we think it's a little soon to draw strong conclusions about its long term dividend potential. During the past two-year period, the first annual payment was €0.49 in 2018, compared to €0.073 last year. As we can see, dividend payments have fallen heavily from where they were two years ago.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, Banca Farmafactoring's earnings per share have shrunk at approximately 5.7% per annum. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're glad to see Banca Farmafactoring has a low payout ratio, as this suggests earnings are being reinvested in the business. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In summary, we're unenthused by Banca Farmafactoring as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Banca Farmafactoring that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:BFF

BFF Bank

Engages in non-recourse factoring and credit management activities towards public administration bodies and private hospitals in Italy, Croatia, the Czech Republic, France, Greece, Poland, Portugal, Slovakia, and Spain.

Outstanding track record and undervalued.

Market Insights

Community Narratives