Is Aurora Solar Technologies (CVE:ACU) In A Good Position To Invest In Growth?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Aurora Solar Technologies (CVE:ACU) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Aurora Solar Technologies

How Long Is Aurora Solar Technologies's Cash Runway?

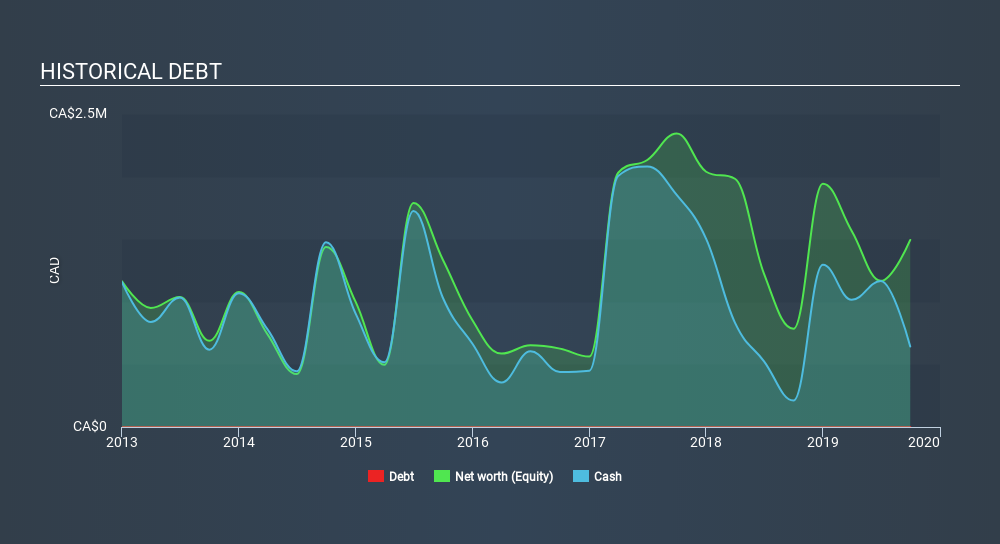

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at September 2019, Aurora Solar Technologies had cash of CA$643k and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through CA$1.0m. That means it had a cash runway of around 8 months as of September 2019. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. The image below shows how its cash balance has been changing over the last few years.

How Is Aurora Solar Technologies's Cash Burn Changing Over Time?

Although Aurora Solar Technologies had revenue of CA$2.2m in the last twelve months, its operating revenue was only CA$2.2m in that time period. We don't think that's enough operating revenue for us to understand too much from revenue growth rates, since the company is growing off a low base. So we'll focus on the cash burn, today. Given the length of the cash runway, we'd interpret the 38% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Aurora Solar Technologies is growing revenue over time by checking this visualization of past revenue growth.

Can Aurora Solar Technologies Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Aurora Solar Technologies to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of CA$8.4m, Aurora Solar Technologies's CA$1.0m in cash burn equates to about 12% of its market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Aurora Solar Technologies's Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Aurora Solar Technologies's cash burn reduction was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. For us, it's always important to consider risks around cash burn rates. But investors should look at a whole range of factors when researching a new stock. For example, it could be interesting to see how much the Aurora Solar Technologies CEO receives in total remuneration.

Of course Aurora Solar Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:ACU

Aurora Solar Technologies

Develops, manufactures, and markets material inspection and inline quality control systems for the solar polysilicon, wafer, cell, and module manufacturing industries in Asia and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives