Is Asseco Business Solutions S.A.'s (WSE:ABS) CEO Being Overpaid?

In 2012 Wojciech Barczentewicz was appointed CEO of Asseco Business Solutions S.A. (WSE:ABS). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Asseco Business Solutions

How Does Wojciech Barczentewicz's Compensation Compare With Similar Sized Companies?

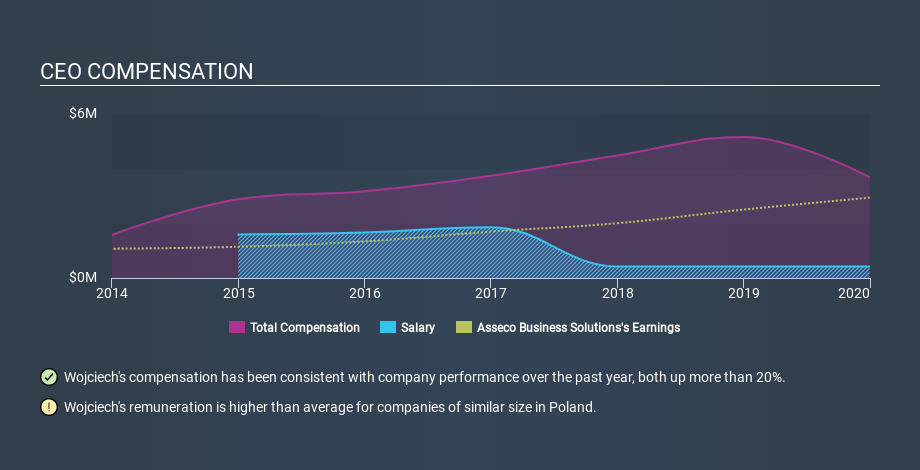

Our data indicates that Asseco Business Solutions S.A. is worth zł1.0b, and total annual CEO compensation was reported as zł3.7m for the year to December 2019. That's less than last year. While we always look at total compensation first, we note that the salary component is less, at zł420k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We looked at a group of companies with market capitalizations from zł424m to zł1.7b, and the median CEO total compensation was zł1.5m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of Asseco Business Solutions. On a sector level, around 65% of total compensation represents salary and 35% is other remuneration. Non-salary compensation represents a greater slice of the remuneration pie for Asseco Business Solutions, in sharp contrast to the overall sector.

As you can see, Wojciech Barczentewicz is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Asseco Business Solutions S.A. is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance. The graphic below shows how CEO compensation at Asseco Business Solutions has changed from year to year.

Is Asseco Business Solutions S.A. Growing?

Over the last three years Asseco Business Solutions S.A. has seen earnings per share (EPS) move in a positive direction by an average of 17% per year (using a line of best fit). It achieved revenue growth of 7.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. You might want to check this free visual report on analyst forecasts for future earnings.

Has Asseco Business Solutions S.A. Been A Good Investment?

Asseco Business Solutions S.A. has served shareholders reasonably well, with a total return of 29% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

We compared total CEO remuneration at Asseco Business Solutions S.A. with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. Looking at the same time period, we think that the shareholder returns are respectable. You might wish to research management further, but on this analysis, considering the EPS growth, we wouldn't call the CEO pay problematic. On another note, we've spotted 1 warning sign for Asseco Business Solutions that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:ABS

Asseco Business Solutions

Designs and develops enterprise software solutions in Poland and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion